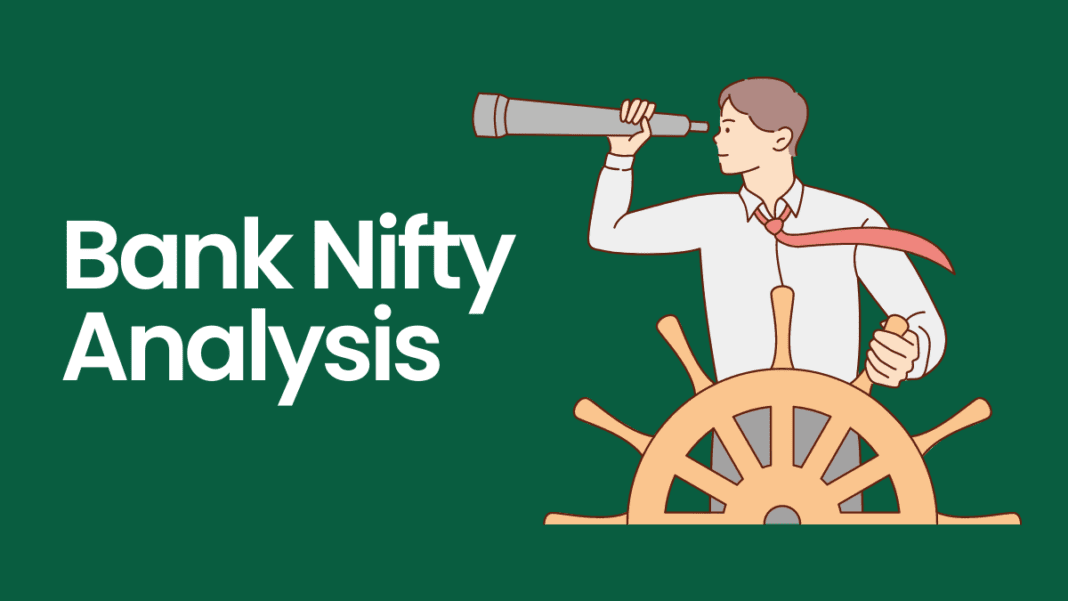

Bank Nifty analysis – 19 May:

- The sell-side liquidity seems attractive to me.

- There has been no down move since the initial low.

- The algos may make a run for this liquidity to liquidate the intraday longs that have been built till now.

- Just an observation. It may or may not work.

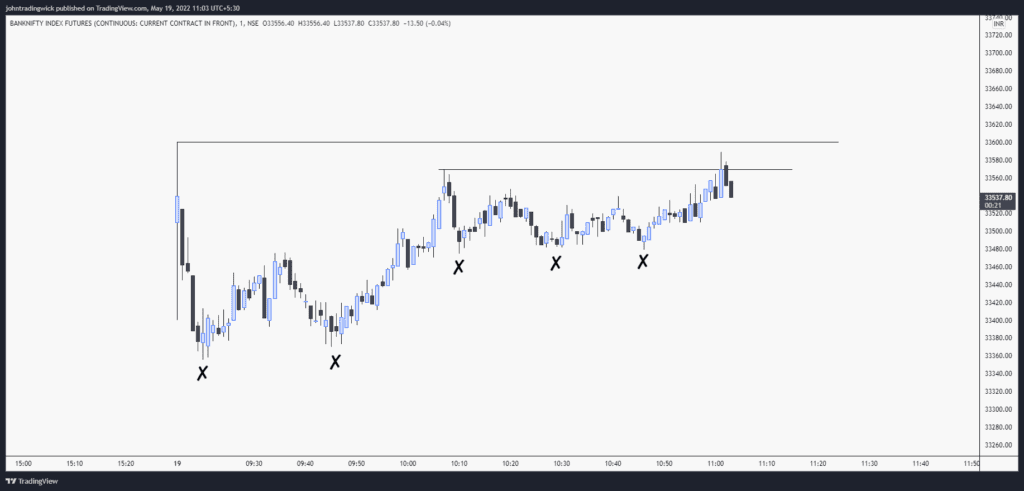

Bank Nifty analysis – 19 May | Update (11:17 am):

- Let’s see the above chart in a simpler way.

- The sell-side liquidity is the stop losses of buyers. These buyers have some defined stop-loss levels, which are easy to guess.

- The algos/banks/institutions/operators (whichever entity you want to use), can assess these stop losses and will use it against you.

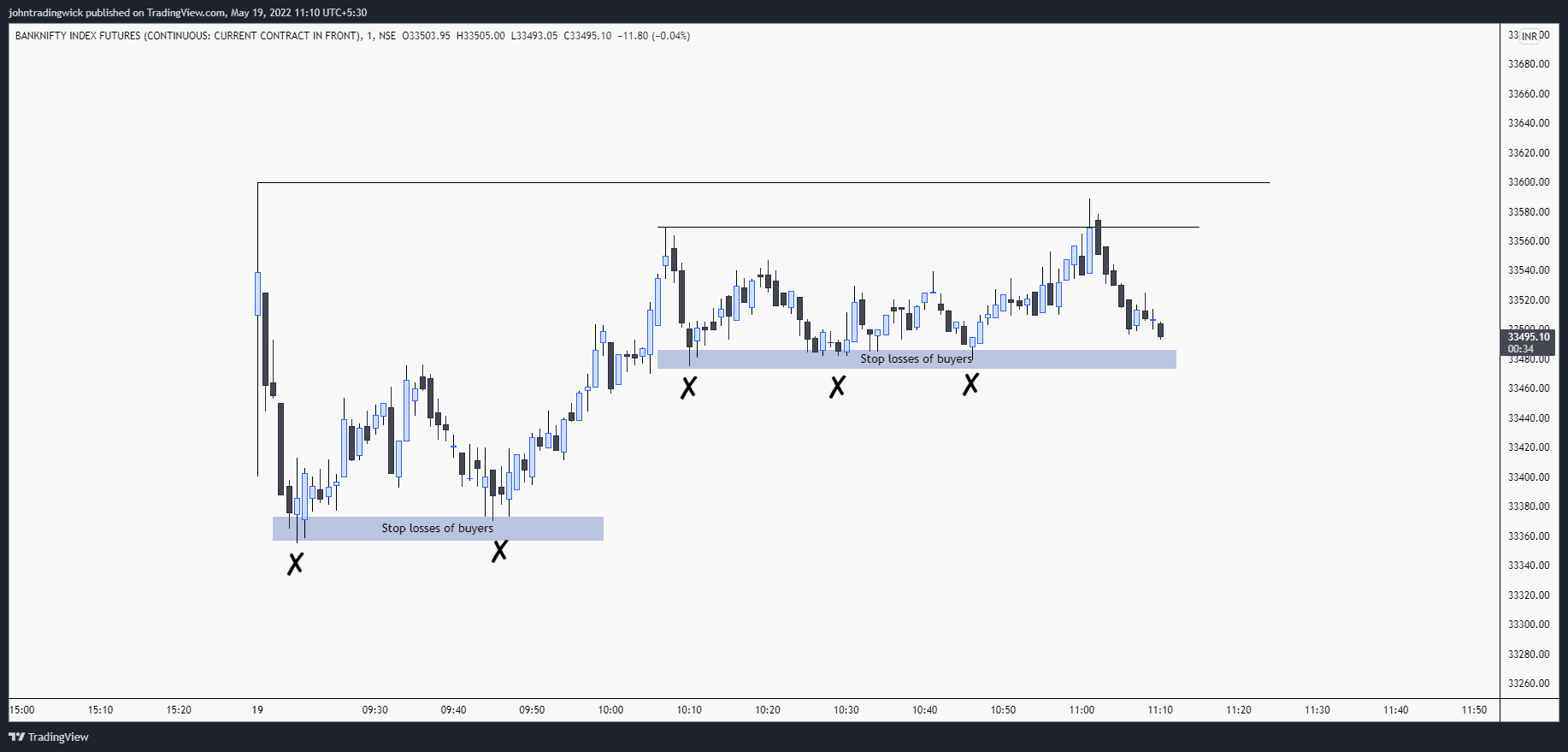

Bank Nifty analysis – 19 May | Update (12:00 pm):

- Played out well, more than 200 points down now.

- The counter-trend trading intraday buyers got trapped and liquidated.

- Now a similar case can be built for buy-side liquidity/short positions. However, since the HTF is heavily bearish, it’s difficult to predict the extent of the pullback.

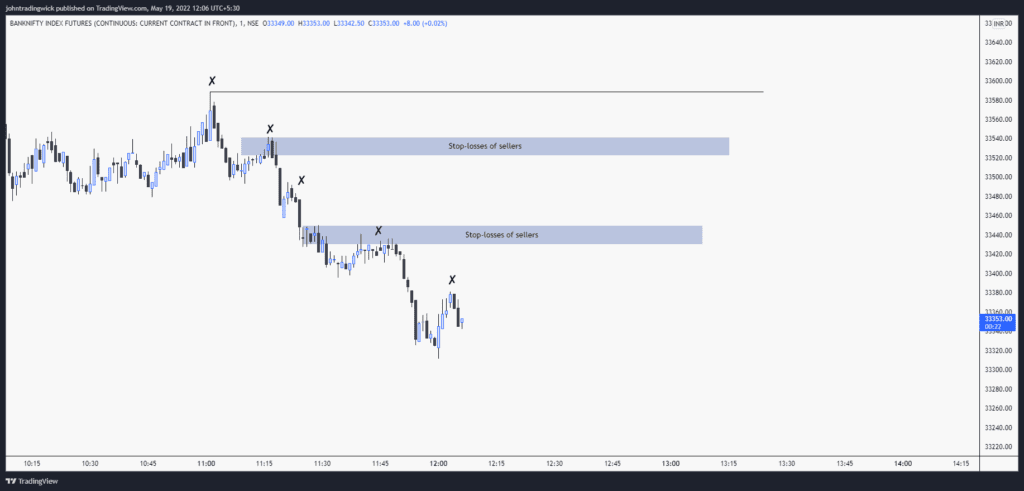

Update (12:07 pm):

- Here’s buy-side liquidity. Clearly, there are plenty of stop losses at these points.

- The price may hit some of these levels before continuing downwards. Also, the price may not even come to these levels today and just keep falling.

- When the trend is too strong, it becomes difficult to pinpoint the pullback levels. Consider these charts as a learning aid to understand the concepts.

Important links:

- Follow the free Telegram channel for early updates.

- What is Divergence trading?

- What is Bullish divergence?

- How to use the TradingView heatmap?