Last time, I explained some of the basics to know when it comes to understanding divergences in the markets. If you haven’t read that post, be sure to check it out here: What is Divergence trading?

In this post, we are going to examine bullish divergence further, along with a few exhibits. Please remember this is an educational post to help everyone better understand investing and trading principles. In no way I am trying to promote a particular style of trading!

Table of contents:

1. What is bullish divergence?

2. Types of bullish divergence

3. Some examples

When the price of an asset is moving in the opposite direction of a technical indicator, such as an oscillator, it is called divergence. Divergence warns about potential underlying weakness in the current trend.

What is bullish divergence?

A bullish divergence occurs when prices fall to a new low while the oscillator fails to reach a new low (exception being hidden bullish divergence). Positive divergence signals that the price could start moving higher soon. Generally, a bullish divergence occurs at the end of a downtrend. It has two sub-types:

– Regular Bullish divergence

– Hidden Bullish divergence

What is classic bullish divergence?

This type of divergence occurs at the end of a bearish trend and indicates that a trend reversal may occur soon. In this, the price and the oscillator always either form lower lows or equal lows. It can be subdivided into 3 types, based on the strength.

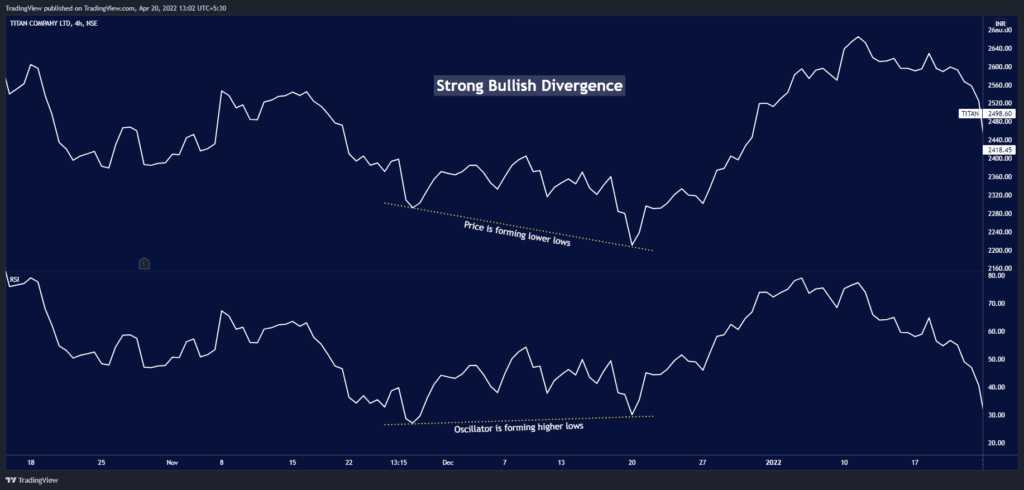

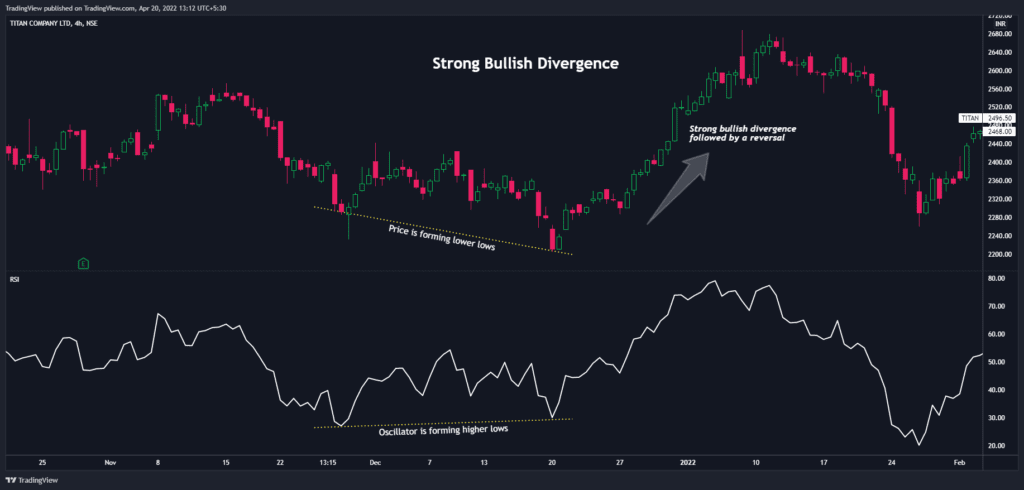

1. Strong Bullish Divergence

In this, the price forms lower lows but the oscillator forms higher lows. This means that the sellers are not selling at the same momentum i.e. the selling momentum is decreasing.

Price: Lower lows

Oscillator: Higher lows

Exhibit: Strong Bullish Divergence

Exhibit: Strong bullish divergence followed by a reversal

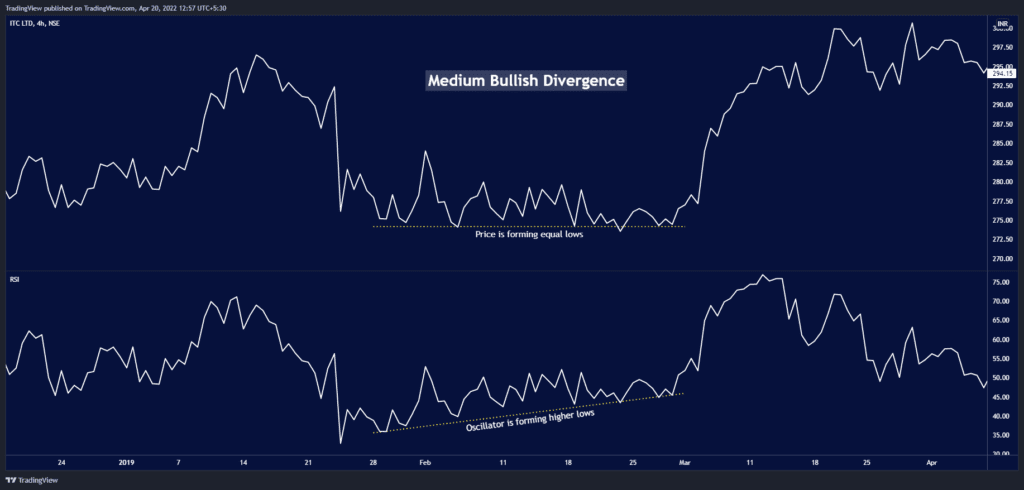

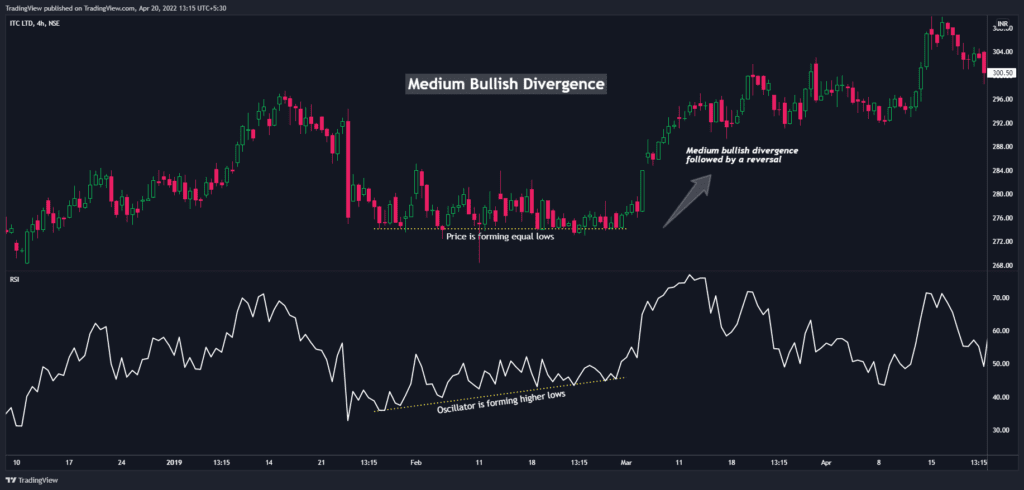

2. Medium Bullish Divergence

The price makes double bottom (almost the same level as the previous low) and the oscillator makes higher lows. This indicates that at the same price levels, the momentum is increasing.

Price: Equal lows

Oscillator: Higher lows

Exhibit: Medium bullish divergence

Exhibit: Medium bullish divergence followed by a reversal

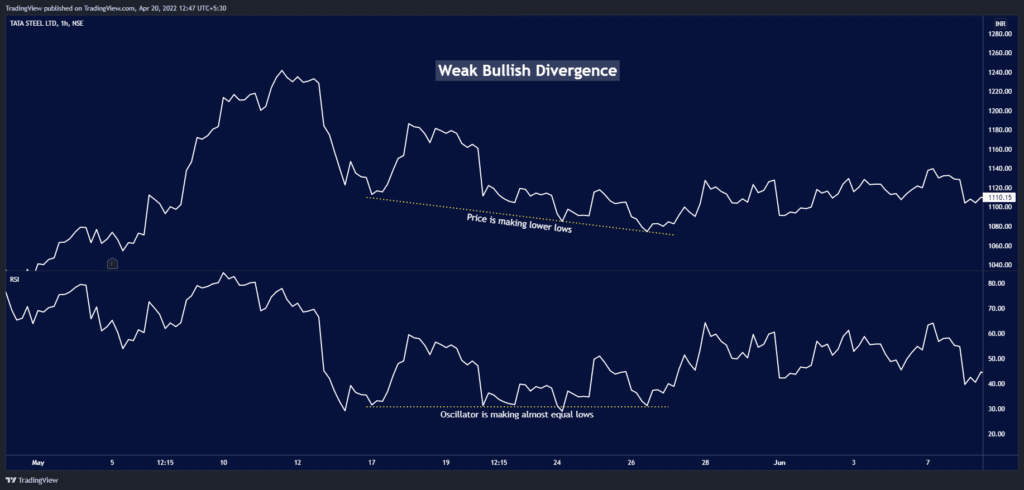

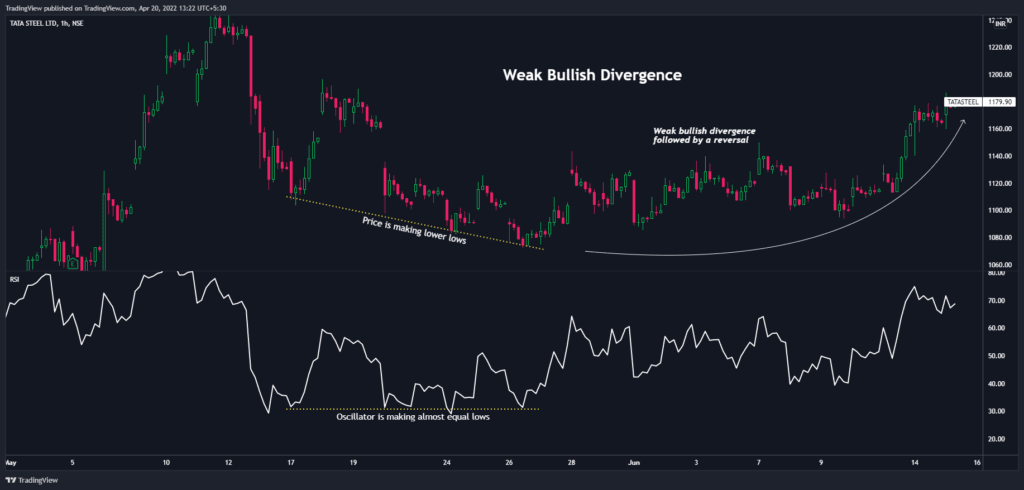

3. Weak Bullish Divergence

In this, the price makes lower lows but the oscillator has almost equal lows. This means, that even though the price is decreasing, the momentum is intact.

Price: Lower lows

Oscillator: Equal lows

Exhibit: Weak bullish divergence

Exhibit: Weak bullish divergence followed by a reversal

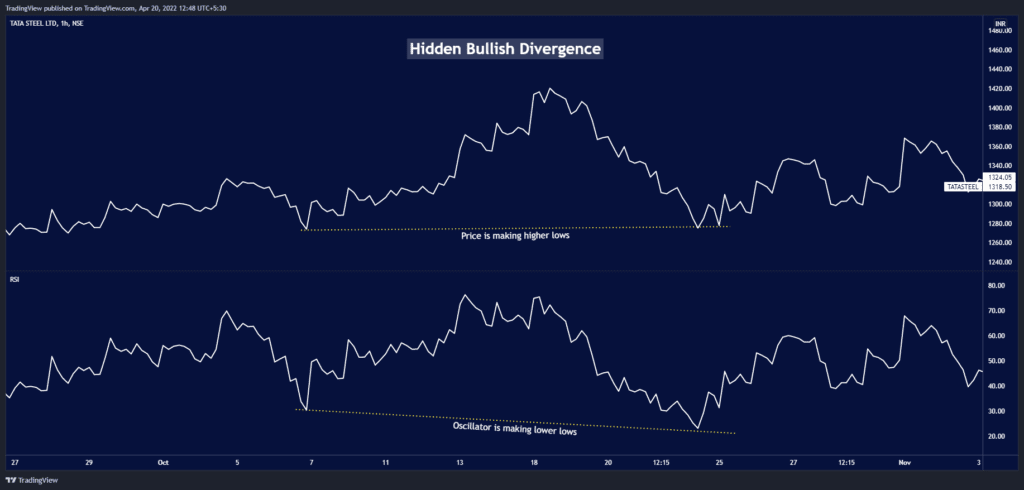

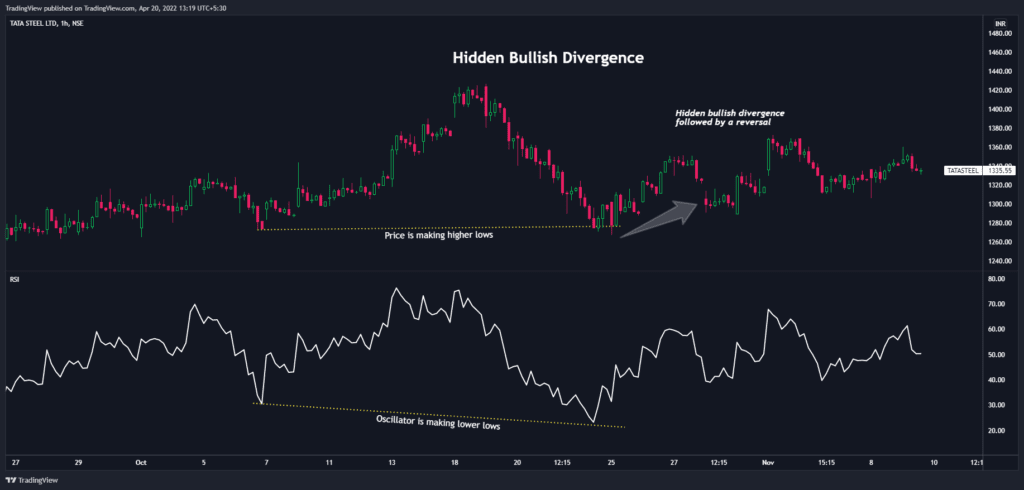

What is hidden bullish divergence?

The Hidden divergence occurs during the correction phase of a trend and is a possible sign of a trend continuation. In this, the price forms higher lows, but the oscillator forms lower lows. This indicates that even at a decreasing momentum, there is enough buying going on to push the price upwards. This type of divergence occurs with less frequency as compared to the other types.

Price: Higher lows

Oscillator: Lower lows

Exhibit: Hidden bullish divergence

Exhibit: Hidden bullish divergence followed by a reversal

Thanks for reading. Hope this was helpful!

Important links:

- Follow the free Telegram channel for early updates.

- What is Divergence trading?

- How to see idea statistics on TradingView?

- How to use the TradingView heatmap?