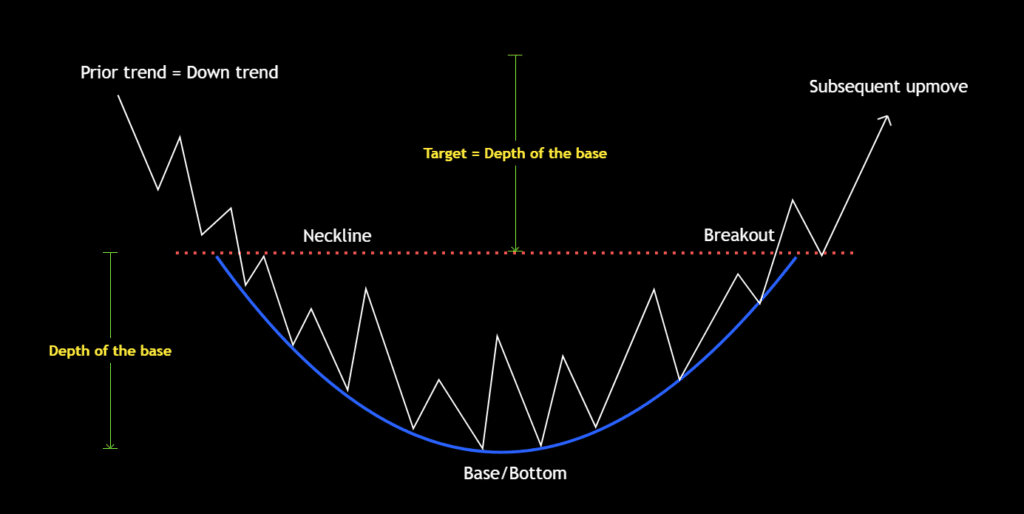

The rounding bottom, also referred to as a saucer bottom, represents a bullish reversal pattern that typically emerges at the end of a downtrend. This pattern signifies a gradual shift from selling pressure to buying pressure, ultimately resulting in a trend reversal.

Characterized by a gentle downward slope followed by a rounded trough and an upward slope, the rounding bottom pattern emerges when the price fails to breach the support level at the trough’s lowest point. Instead, the price starts to climb as sellers lose momentum and buyers gain dominance. This transition is commonly accompanied by a decline in trading volume, which further signals weakened supply and a potential reversal.

The purpose of this article is to offer insights into the following topics:

➡ Fundamentals and identification of the rounding bottom pattern

➡ Key components

➡ Essential aspects to consider

What is a Rounding bottom?

- A rounding bottom is a bullish reversal pattern that takes on a “U” shape, signalling a potential change in market sentiment.

- These patterns generally appear after extended downtrends, indicating a potential trend reversal.

- The rounding bottom pattern is also referred to as a saucer bottom, the pattern earns its name due to its resemblance to a saucer.

- In an ideal scenario, volume and price movements should align; however, these correlations can diverge considerably in practice.

- When the price rises from the neckline, it demonstrates underlying strength, suggesting that the asset may be embarking on a new uptrend.

Key Components of a Rounding top pattern:

The formation of a rounding bottom pattern can be broken down into three significant phases, which are:

• Decline

• Formation of base

• Advance

Important aspects:

1. Prior Trend

The pattern must be preceded by a significant downward move, indicating a bearish sentiment in the market.

2. Advance

The initial phase of the pattern is characterized by a decline that leads to the formation of the pattern’s low. This decline can take on various forms, ranging from jagged movements with several reaction highs and lows to a more linear downward trajectory. The sell-off or decline that leads to the pattern’s low can also vary significantly. In some instances, the downtrend may have multiple whipsaws, while in other cases, the asset may trade flat.

3. Low

Typically, the pattern takes the shape of a “U” at the bottom. However, it can also resemble a “V” or a “W,” as long as the low isn’t too sharp. It’s worth noting that there is always the possibility of a new low due to a selling climax, which can lead to a variation in the pattern’s overall shape.

4. Advance

Generally, the rounding bottom pattern’s right half mimics the timeframe of the left half, resulting in a balanced pattern. This means that the duration of the price advance should be roughly similar to that of the preceding downtrend. In simpler terms, the right half’s formation should take approximately the same amount of time as the left half.

It’s essential to note that the upward price movement should not be excessively steep, as a sharp rise could suggest a potential bull trap. Thus, a gradual, steady ascent is preferred to ensure the pattern’s stability and reliability.

5. Breakout

A breakout above the reaction highs and neckline serves as a bullish confirmation of the rounding bottom pattern. When the price breaks above the neckline or resistance level, accompanied by a surge in trading volume, the pattern is considered complete, and a bullish trend is expected to follow. It’s important to note that after the breakout, the price may test the demand by returning to the neckline before continuing its upward trend.

6. Volume

Ideally, the trading volume should increase as the rounding bottom pattern forms and spike when the price breaks above the resistance level, confirming the bullish reversal. However, it’s essential to note that these are only guidelines and the volumes may vary in practice.

Volume levels will track the shape of a rounding bottom:

- High during the down move

- Low during the formation of the base

- Rising during the up move

7. Target

Using the measurement objective technique, traders can determine the price target of the rounding bottom pattern, which is equivalent to the depth of the pattern’s base.

To calculate this, measure the vertical distance between the lowest point of the pattern’s base and the neckline, which serves as a crucial reference level for the pattern. By adding this distance to the neckline’s breakout point, traders can estimate the price target for the bullish reversal.

8. Stop-loss

Ideally, traders should position a stop-loss order at the lowest point of the rounding bottom pattern’s base. However, if the price has oscillated near the neckline, creating a series of swing highs and lows, then the stop-loss order can also be placed below the most recent swing low.

Exhibits

Rounding bottom pattern with a failed breakout

Rounding bottom pattern with a steep base

Like this article? Don’t forget to share it! Follow me on Twitter and YouTube for more educational content.