A bullish market structure is one of the 3 fundamental types of market structures. A thorough understanding of market structure enables traders to align themselves with the market’s trends, thus avoiding counter-trend trading, which ultimately enhances the probability of profitability.

In this post, we’ll dive into the bullish market structure, and see some illustrations and examples to improve our understanding of this fundamental concept. If you aren’t familiar with market structure, I’d suggest you first go through this comprehensive guide to strengthen your basics and lay down a solid foundation

To understand a bullish market structure, it’s important to familiarize ourselves with a bullish trend or an uptrend. This will provide us with the necessary context to recognize the characteristics of a bullish market structure

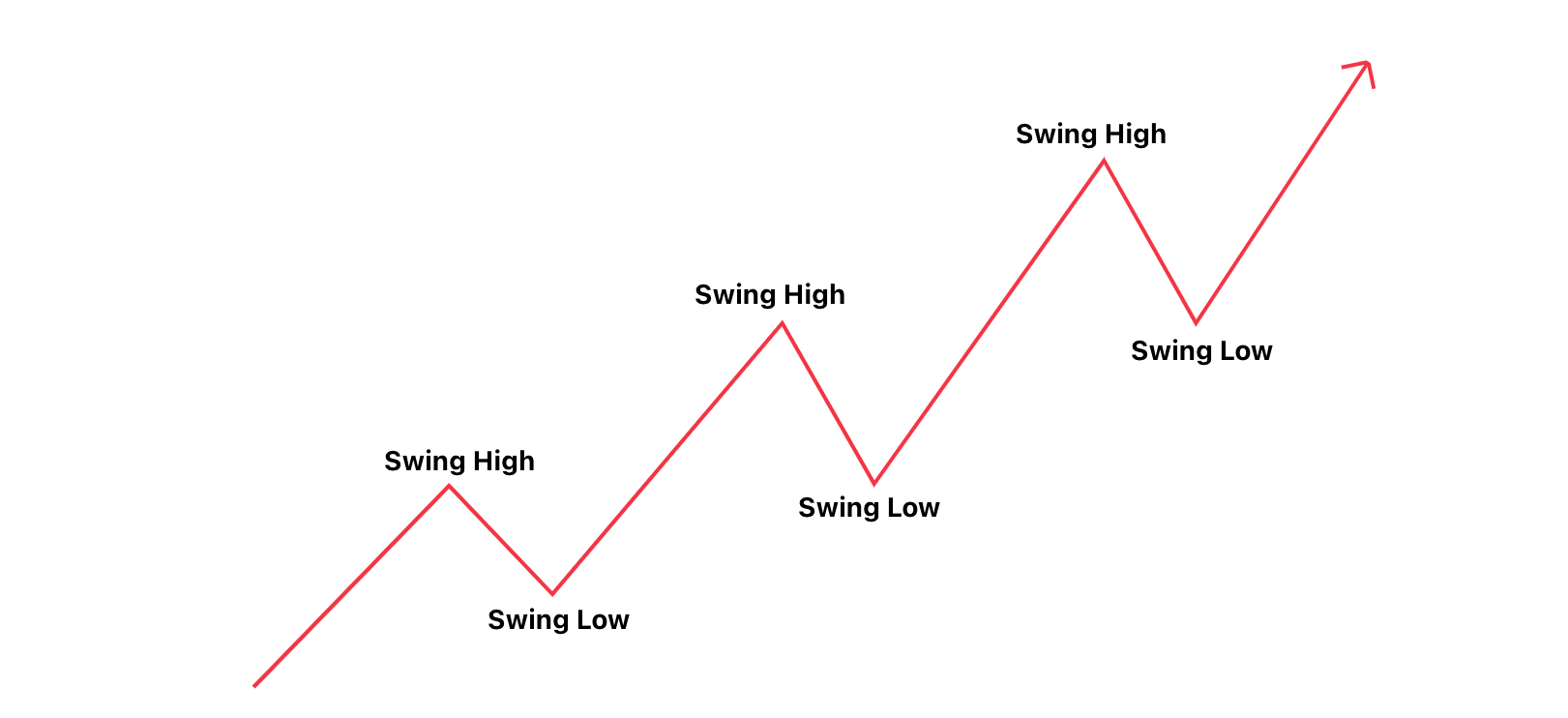

What is an uptrend?

✅ A bullish trend is characterised by a bullish market structure.

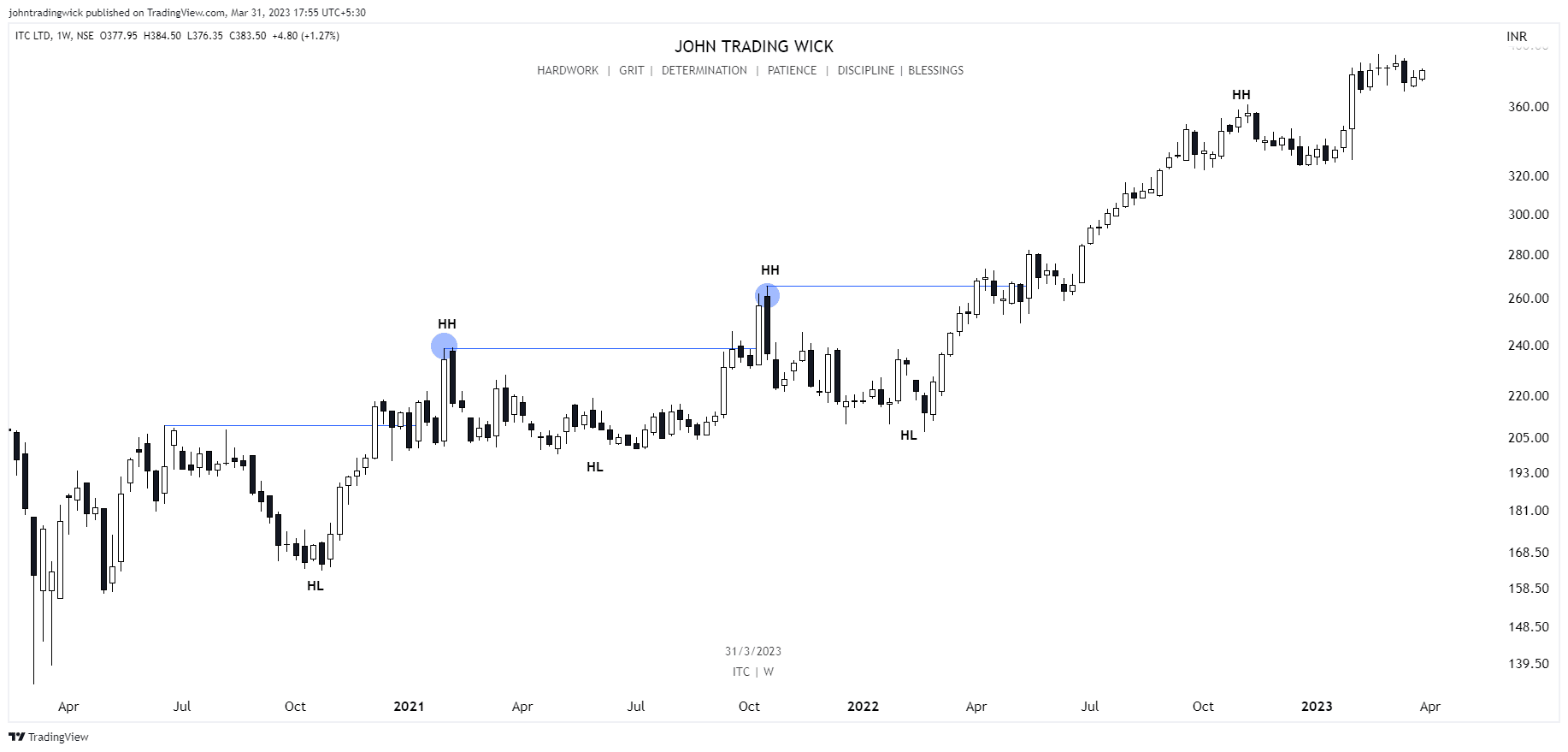

✅ An uptrend contains a series of higher highs followed by higher lows.

✅ For an uptrend to stay intact, it must preserve its descending structure – lower highs must follow lower lows.

What is a Bullish market structure?

A bullish market structure is characterized by a series of consecutive higher highs and higher lows. In simple words, when the price is consistently making higher highs and higher lows, then it implies that the structure is bullish.

Importance of identifying a bullish market structure

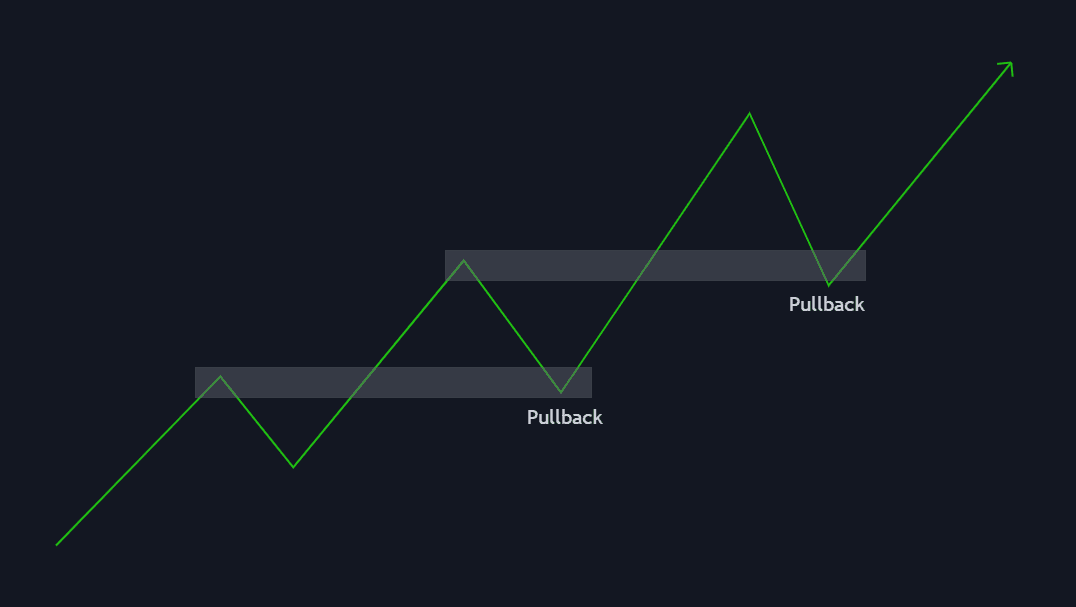

“Identification of the market structure is vital in determining optimal entry and exit points. In a bullish market, previous highs typically serve as support zones, presenting traders with an opportunity to enter new long positions, in hopes of further price appreciation. When the price nears or revisits the prior highs, it is commonly perceived as a buying opportunity known as “buying the dip.” This approach enables traders to purchase assets at a lower price, potentially profiting from the anticipated price surge.

Exhibit: Pullback in a bullish market structure

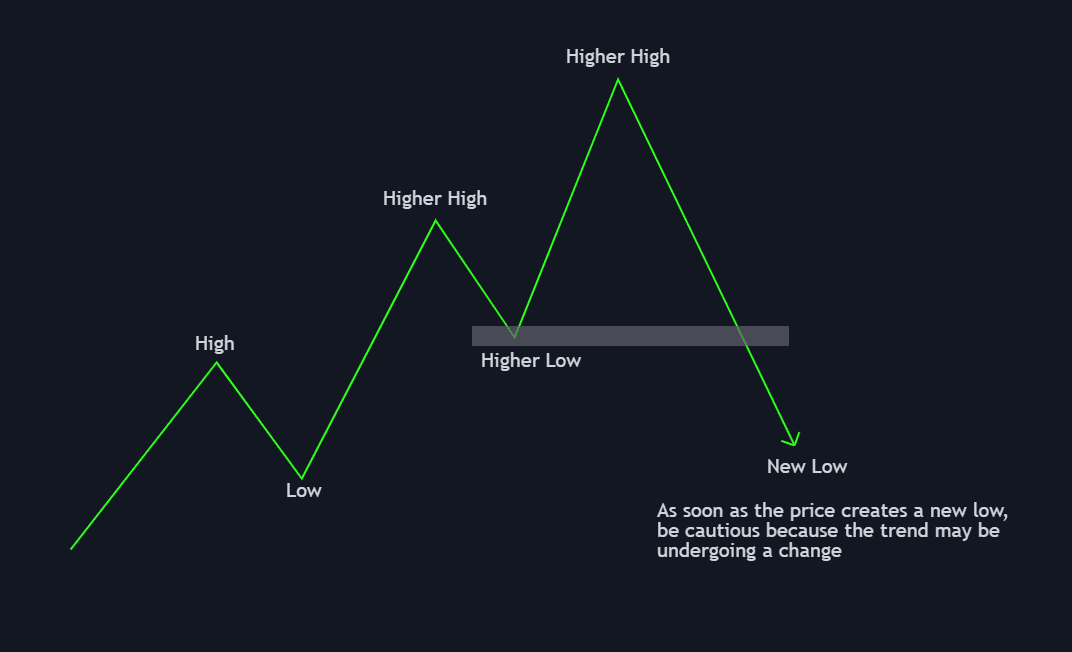

What happens when there is a “Possible” change in Bearish structure?

When a stock is on a bullish trend, and the price unexpectedly drops to a new low, traders should be cautious as it could indicate an impending trend shift. Nevertheless, it’s worth noting that the stock could also go into a consolidation phase before continuing its upward trend, or the drop may be a false signal commonly known as a “bear trap.”

In case the trend shift is validated, traders must exit their long positions and start looking for short trades instead.

Possible scenarios after the formation of a “New Low”:

- Trend reversal from bullish to bearish

- Consolidation followed by a continuation of the prior bullish trend

- Bear trap

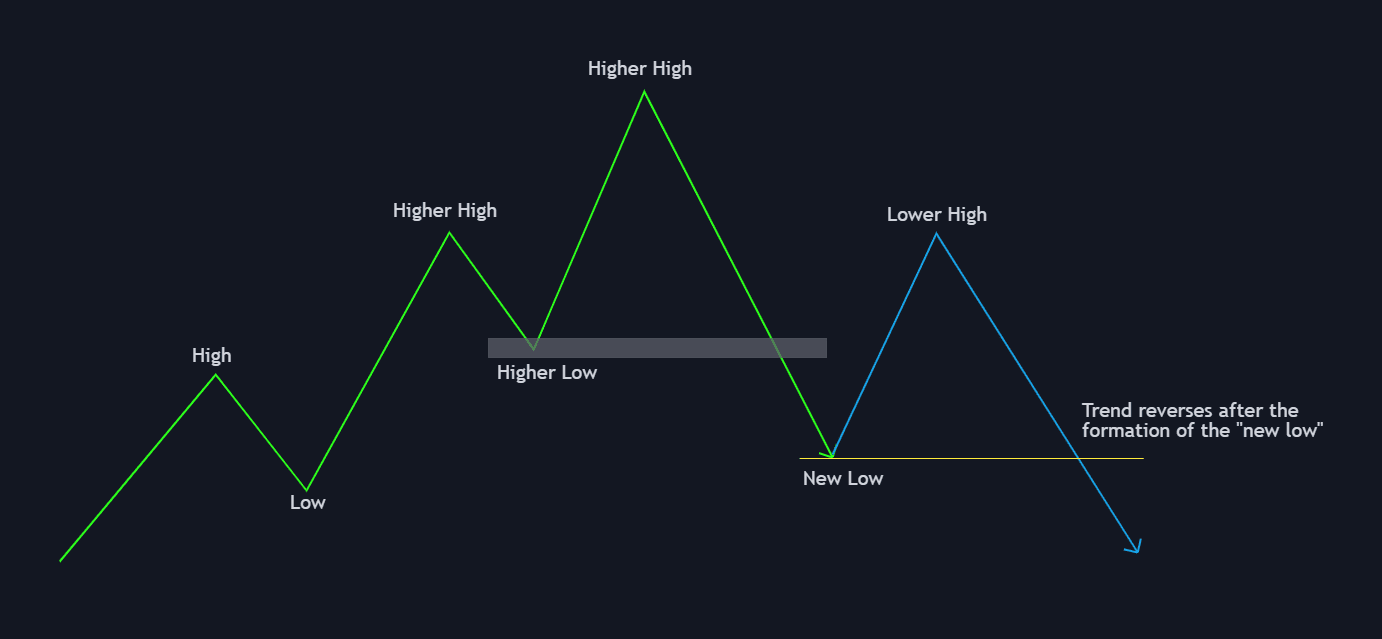

Trend reversal

One possible scenario is a confirmed trend reversal, where a new low is followed by a lower high, ultimately resulting in the formation of a new downtrend. This situation is identified by a continuous downward price movement, indicating a transition from a bullish to a bearish trend.

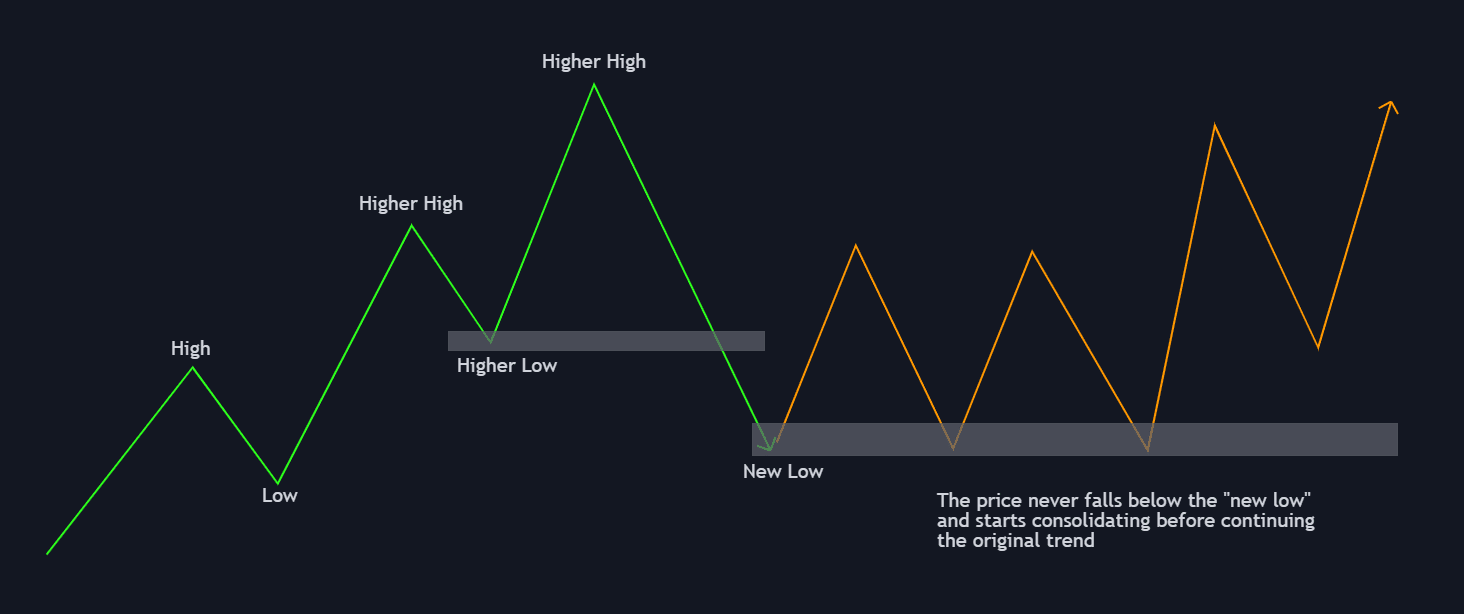

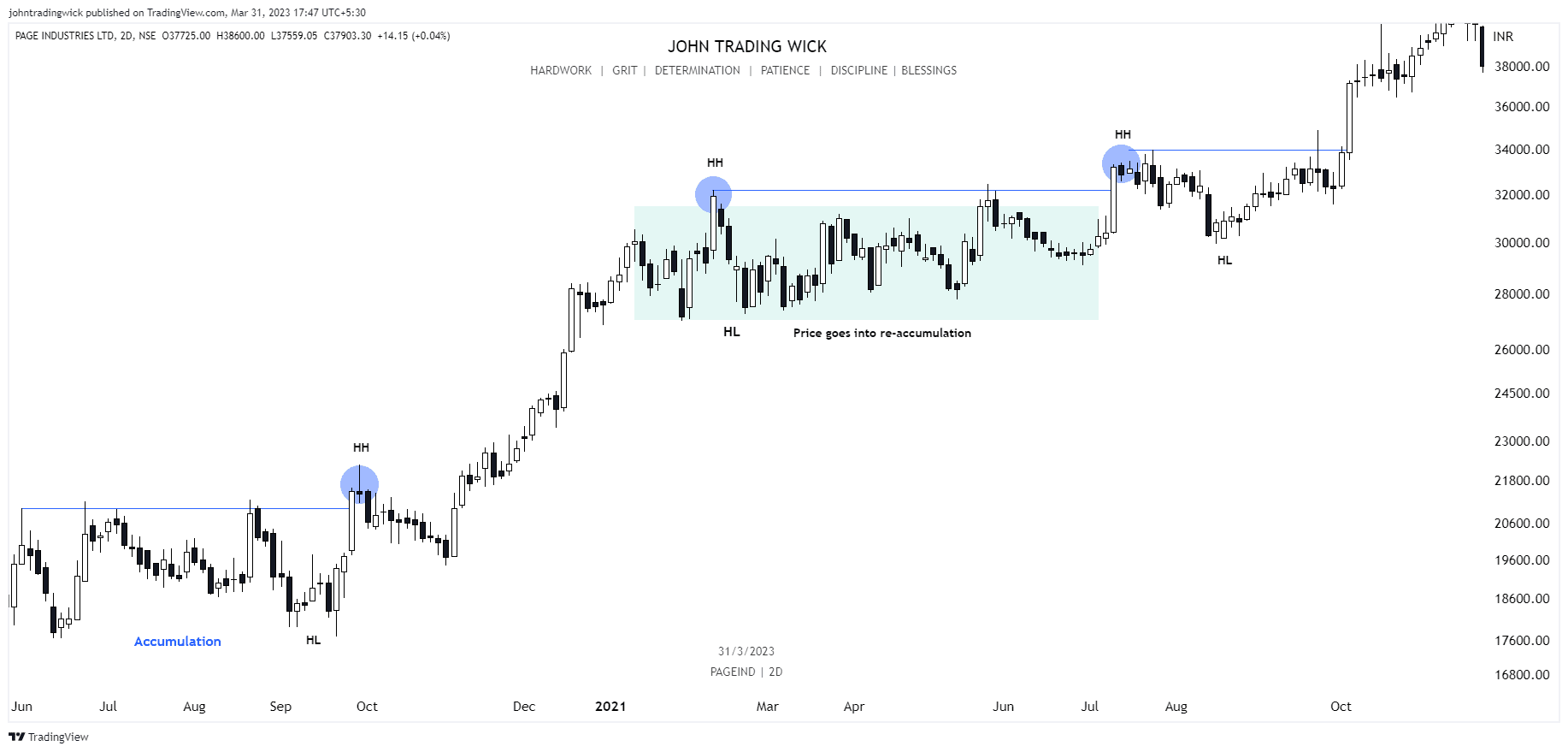

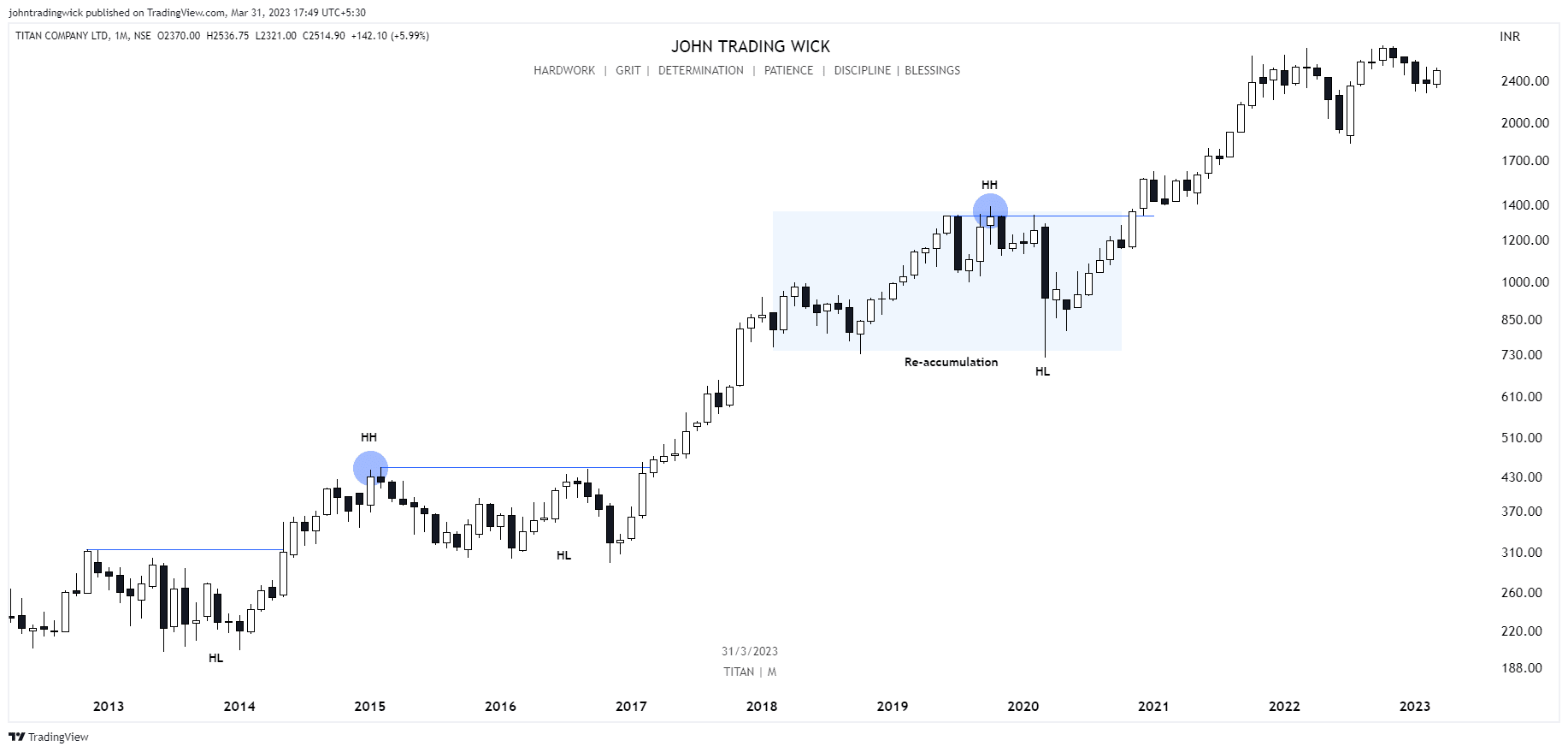

Consolidation and Continuation

In another scenario, following the creation of a “new low,” the price enters a consolidation phase, remaining above this level without any sustained downward movements. It’s worth noting that the price never falls below the “new low” for an extended period and eventually resumes its upward movement, continuing the bullish trend.

Traders must exercise caution during this type of consolidation phase as it could potentially indicate a trend reversal. However, as long as the price remains above the “new low,” the likelihood of the bullish trend continuing is high.

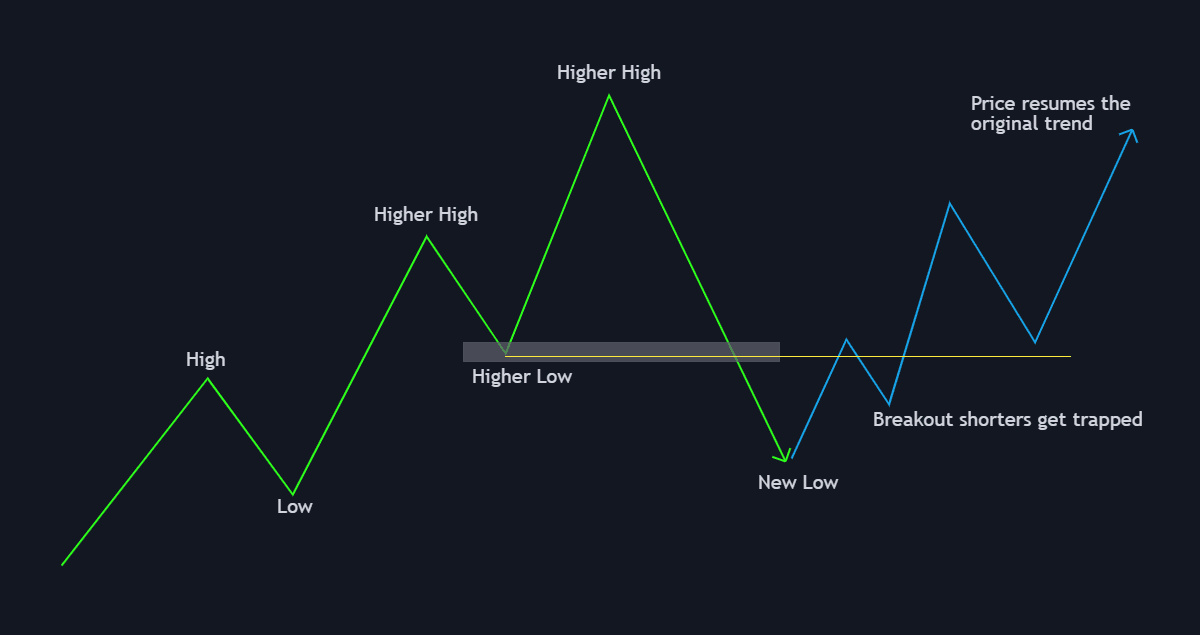

Bear Trap

A “bear trap” is a situation where the price of an asset seemingly breaks below a previous support level, only to reverse suddenly and resume its upward movement. This “breakdown” can lure traders into opening short positions, anticipating a potential price drop. However, the market then reverses direction and moves upward, trapping these early traders in their short positions.

These three scenarios are the primary market structures that can emerge during a bullish trend, and they can occur repeatedly. Therefore, traders must comprehend these concepts thoroughly as they are applicable across all timeframes.

To reinforce your understanding of the bullish market structure, you can try applying these concepts to a random chart and backtest them. Through consistent practice, you’ll gain more experience and become better at identifying these structures.

Regardless of whether you follow a specific trading strategy or not, having a solid understanding of market structure is crucial in enhancing your confidence in making trades and ultimately achieving better trading outcomes. So, continue honing your skills and refining your knowledge, and you’ll be on the path to becoming a more successful trader.

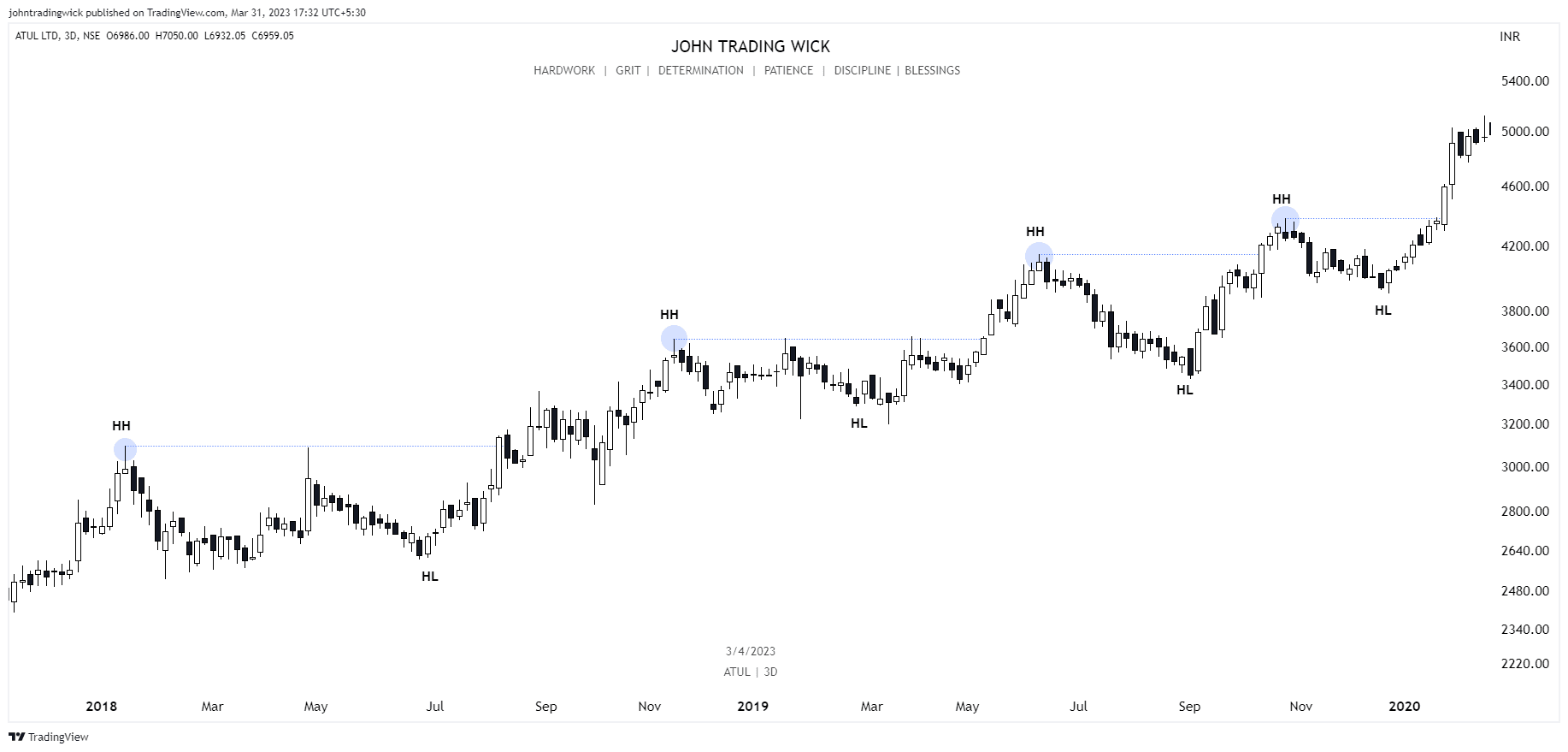

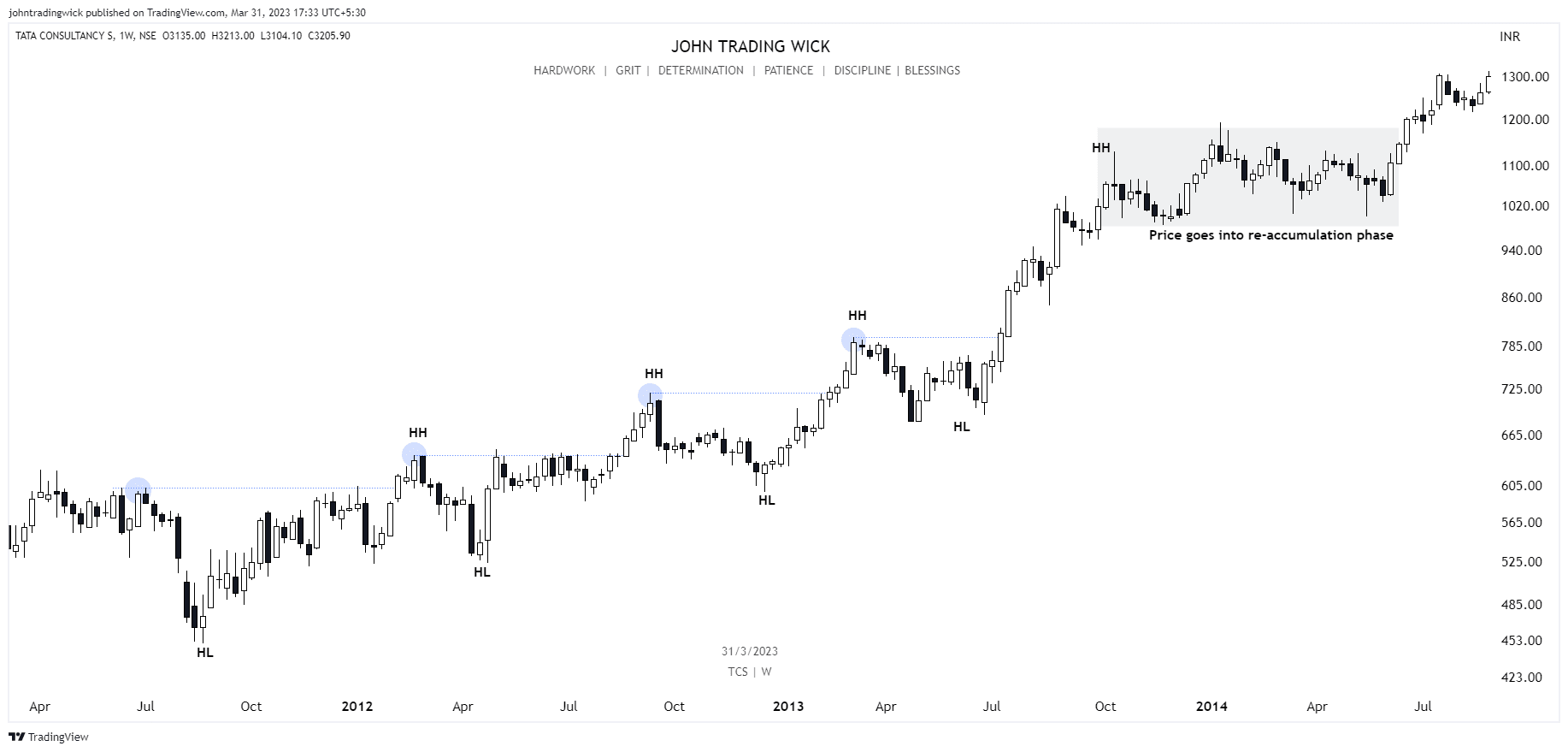

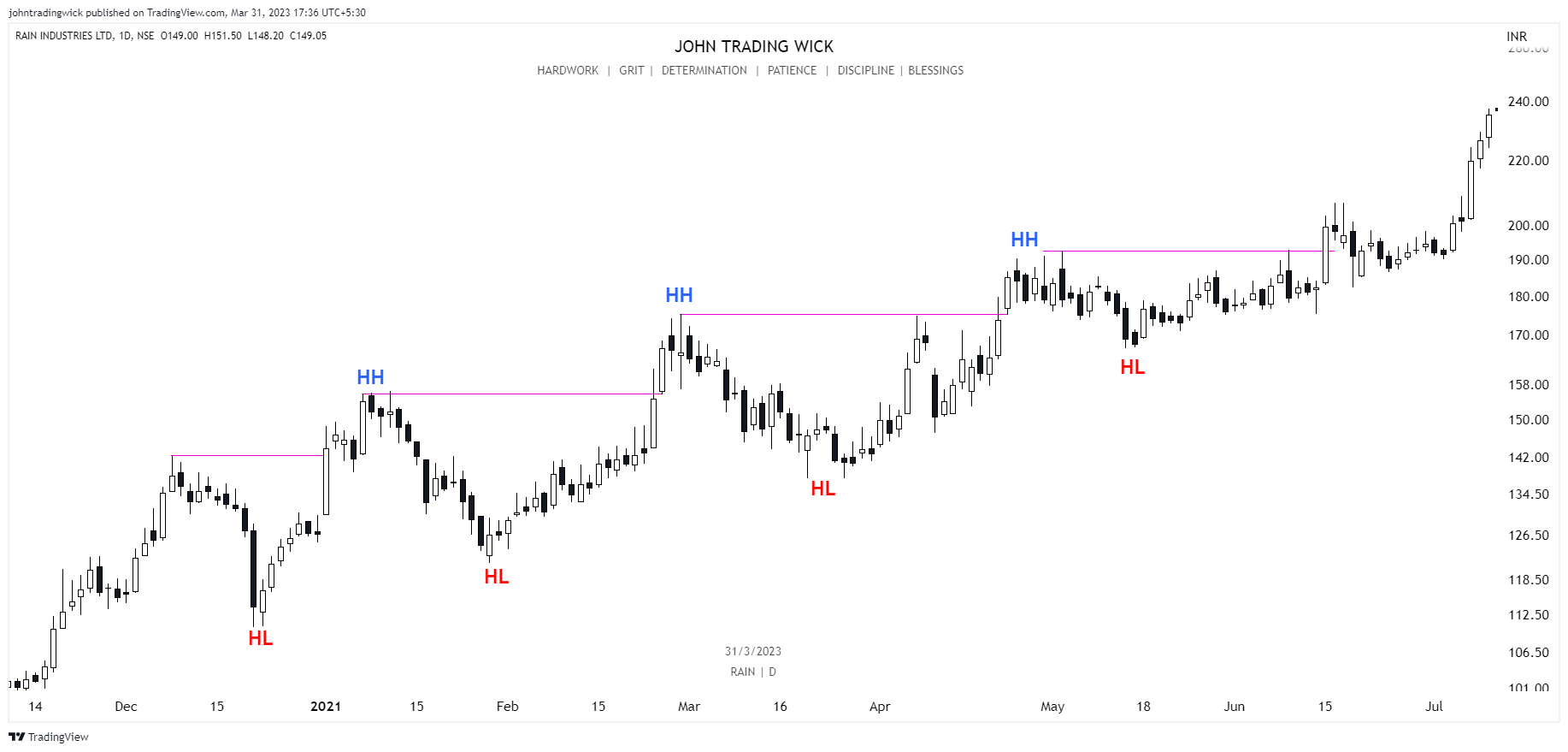

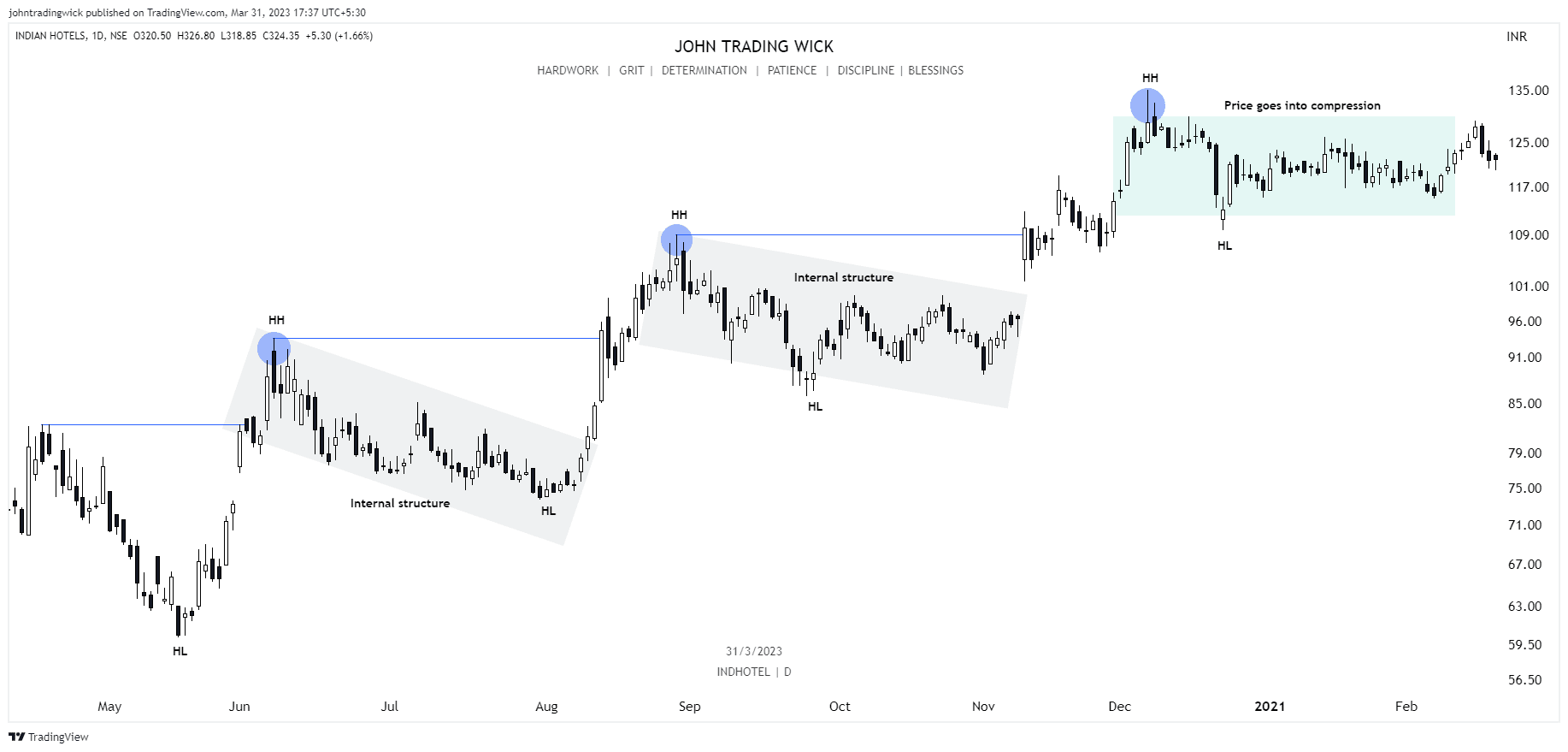

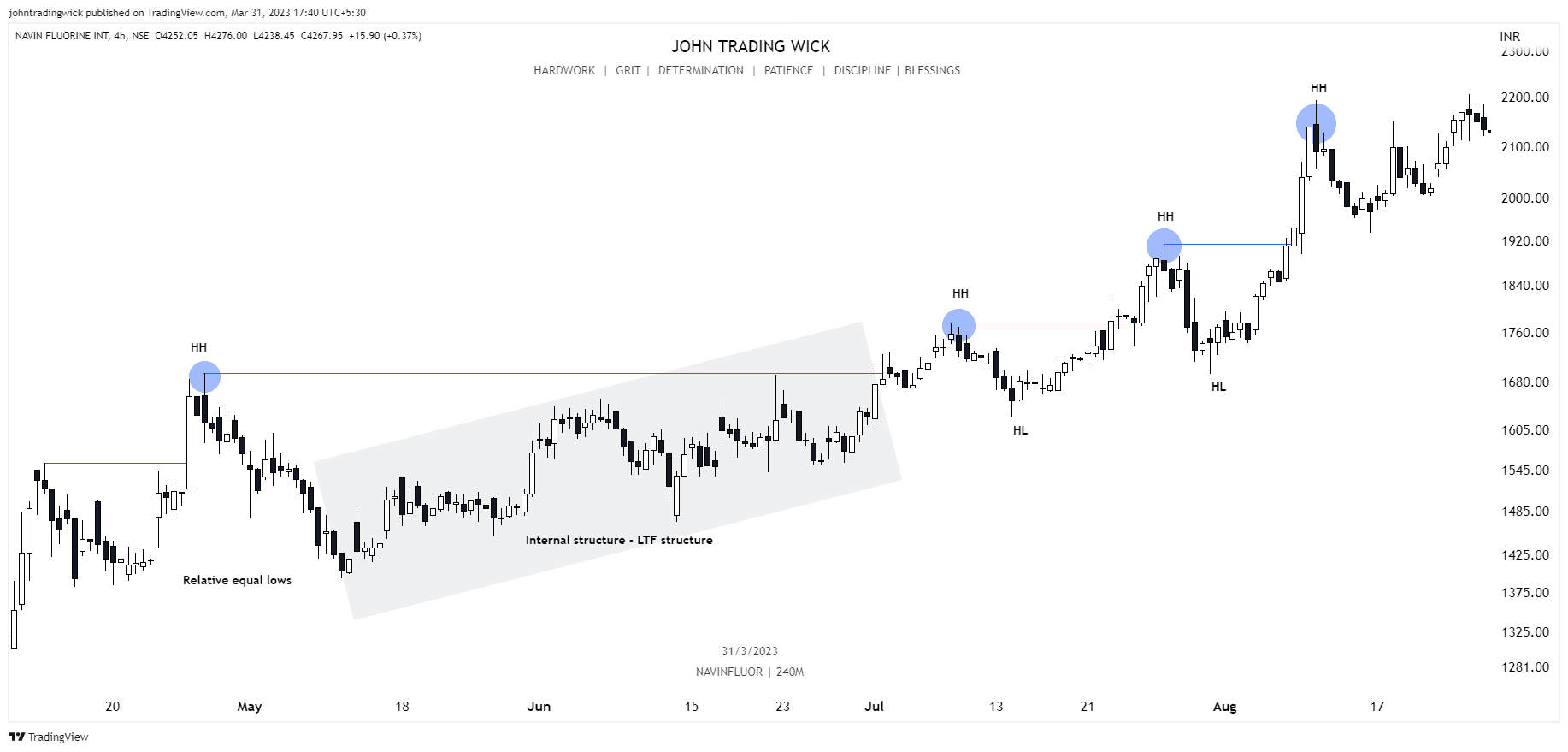

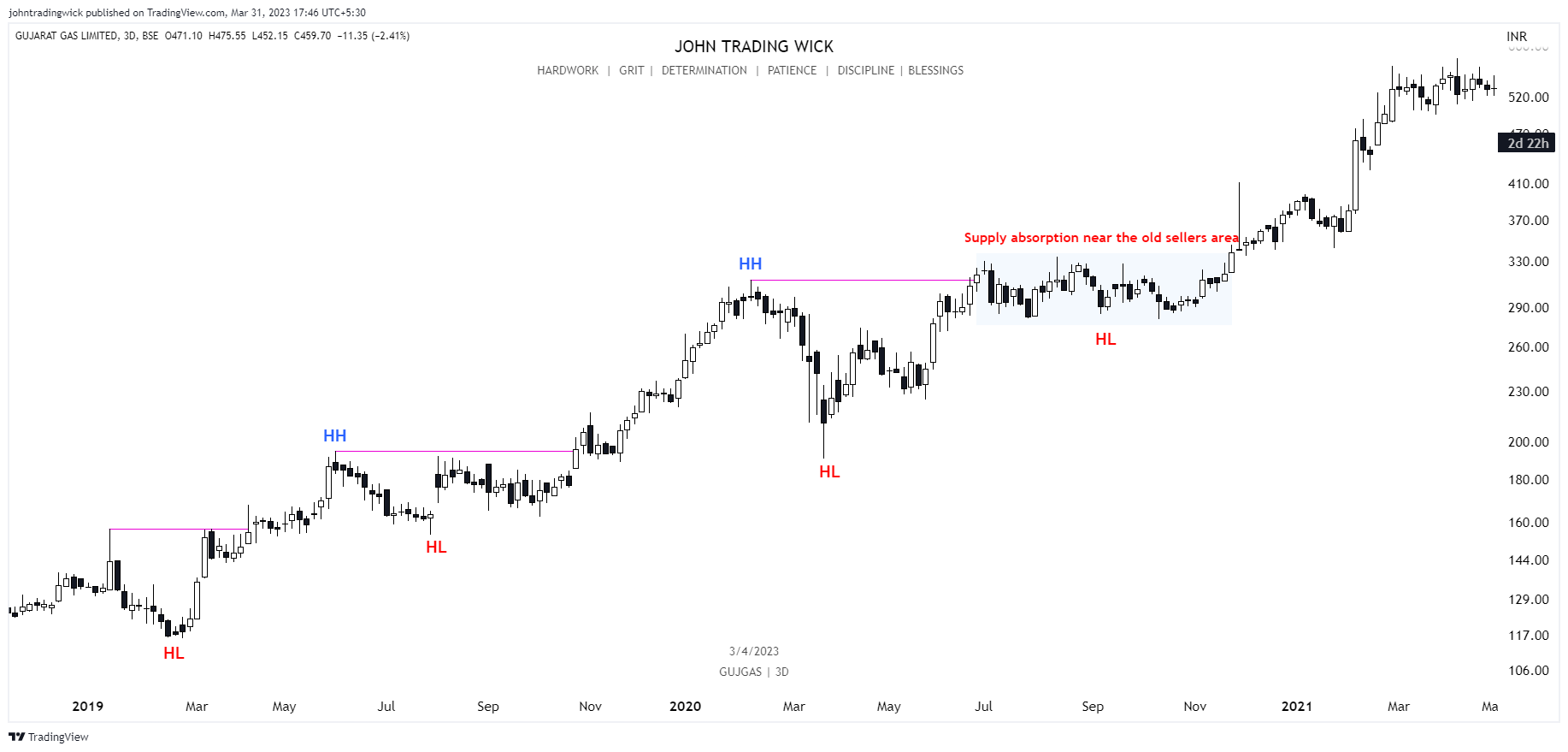

Here are some Chart examples of the Bullish market structure

Like this article? Don’t forget to share it! Follow me on Twitter and YouTube for more educational content.