Who is Peter Lynch?

Peter Lynch is a renowned American investor who is best known for his tenure as the manager of the Magellan Fund at Fidelity Investments from 1977 to 1990. Under Peter Lynch’s leadership, the Magellan Fund became one of the most successful mutual funds in history. During his tenure, the fund averaged an annual return of around 29%, consistently outperforming the S&P 500 index.

In the US, in 1960, individuals allocated 40% of their assets, including their homes, to stocks and mutual funds. By 1980, this figure dropped to 25% and has further decreased to a mere 17% in coming years. Lynch attributed this decline to people’s flawed methods and their tendency to lose money when attempting to invest without proper knowledge.

Peter Lynch’s performance as the manager of the Fidelity Magellan Fund:

Average Annual Return: During Peter Lynch’s tenure from 1977 to 1990, the Magellan Fund achieved an average annual return of approximately 29%. This means that, on average, investors in the fund experienced a 29% annual growth in their investment.

Cumulative Return: Over the course of Lynch’s 13-year management, the Magellan Fund delivered a cumulative return of around 2,700%. This impressive figure indicates the overall growth of the fund’s value during that period.

Assets Under Management: When Lynch took over the Magellan Fund in 1977, it had approximately $18 million in assets. By the time he retired in 1990, the fund’s assets had grown to over $14 billion, a significant increase over the span of just over a decade.

Peter Lynch’s Investment Philosophy

Peter Lynch’s investment philosophy is centered around the idea that individual investors can achieve successful results by leveraging their own knowledge, conducting thorough research, and adopting a long-term approach. His books, such as “One Up on Wall Street” and “Beating the Street,” provide valuable insights into his investment strategies.

Do Your Own Research: Lynch encourages investors to conduct thorough research and analysis of companies before making investment decisions. He emphasizes the importance of researching companies and understanding their products and services.

Invest in What You Know: According to Lynch, it is crucial to focus on industries and companies that individuals can relate to or understand. He believes that individual investors have an advantage when they invest in businesses they are familiar with or have personal experience in.

Focus on Fundamentals: Lynch places a strong emphasis on the fundamental aspects of a company, such as earnings growth, cash flow, and balance sheet strength. He emphasizes the correlation between a company’s earnings and its stock performance over the long term, dismissing the significance of external factors (such as money supply, political events, or economic predictions).

Long-Term Perspective: Lynch advocates for a patient and long-term approach to investing. He suggests that investors should be willing to hold onto their investments for several years to allow for the realization of the company’s growth potential. Instead of trying to time the market, regularly invest a fixed amount of money each month.

Ignore Market Noise: Peter Lynch advised people to ignore short-term market fluctuations and to hold onto their stocks during rough market periods. According to him, the key to making money in stocks is to avoid being scared out of them by short-term volatility.

Contrarian Approach: Lynch often looked for investment opportunities in companies that were overlooked or undervalued by the broader market. He believed that being contrarian and investing in companies with strong growth potential before they became widely recognized could lead to significant returns.

Ten Baggers: Lynch is famous for identifying companies with strong growth potential before they become widely recognized. He popularized the concept of “tenbaggers,” stocks that increase in value by ten times or more, and emphasizes patient investing and long-term thinking. This term was coined by Lynch in his book “One Up on Wall Street”.

Top 10 Investments

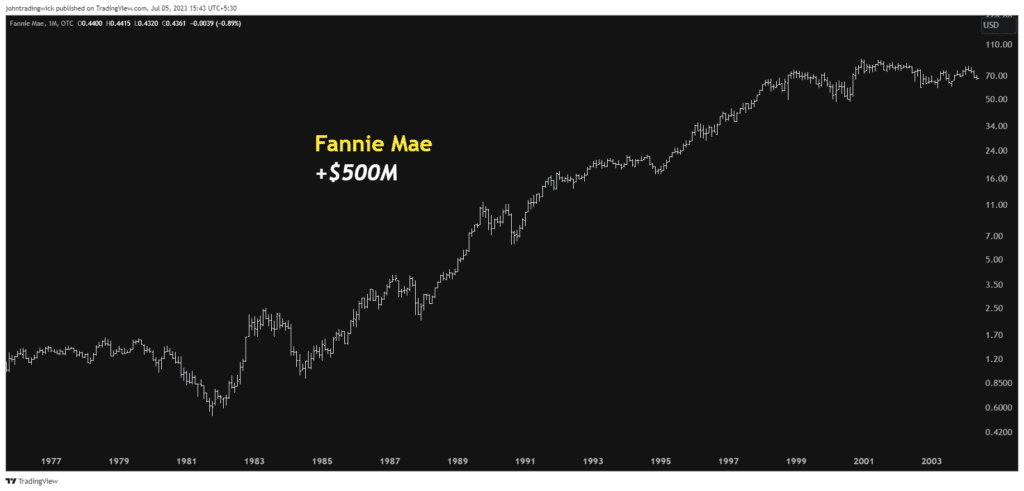

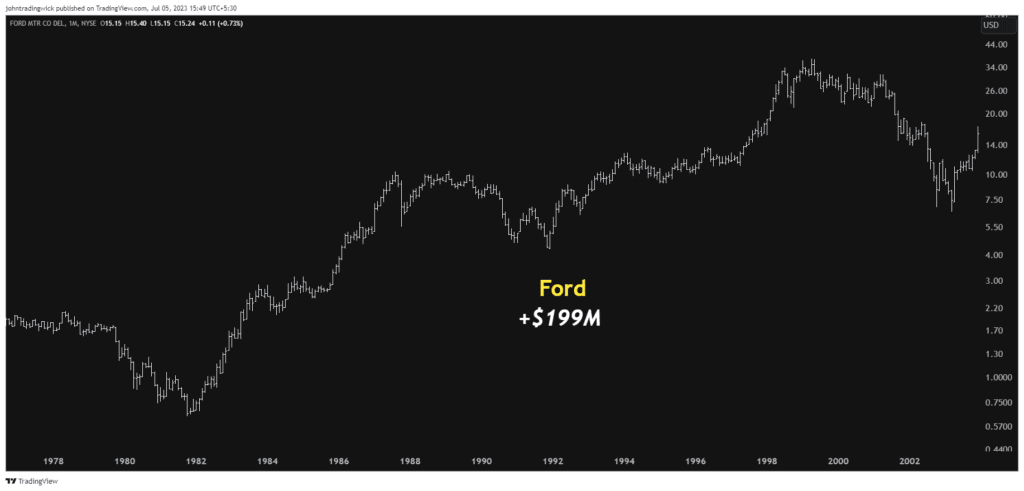

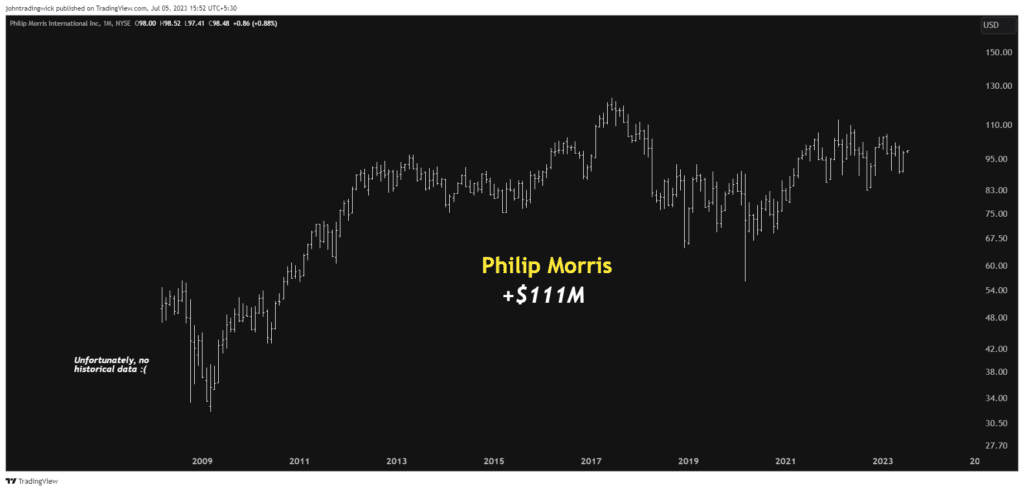

From 1977 until 1990, the Magellan fund averaged a 29.2% annual return and as of 2003 had the best 20-year return of any mutual fund ever. Lynch found successes in a broad range of stocks from different industries.

According to Beating the Street, his top 3 profitable picks while running the Magellan fund were:

1. Fannie Mae

2. Ford

3. Philip Morris

Peter Lynch’s Categorization of Companies

Slow Growers:

- These are companies with stable and mature businesses that generate consistent but slow growth rates.

- They typically operate in mature industries with limited prospects for significant expansion.

- Slow growers often provide dividends and are considered stable investments.

Stalwarts:

- Stalwarts are large, well-established companies that have the potential to grow steadily over time.

- They are dominant players in their industries and generally exhibit consistent earnings and cash flows.

- Stalwarts may not be rapidly growing companies but have the potential to deliver reliable returns.

Fast Growers:

- Fast growers are smaller companies that exhibit rapid earnings growth and operate in industries with high growth potential.

- These companies often reinvest their earnings back into the business to fuel further expansion.

- Fast growers carry higher risks but can deliver substantial returns if they succeed.

Cyclicals:

- Cyclicals are companies whose earnings and stock prices are closely tied to the economic cycle.

- These companies typically experience fluctuating earnings and stock prices as they are sensitive to changes in the overall economy.

- Industries such as automobiles, housing, and manufacturing often fall into this category.

Turnarounds:

- Turnarounds are companies that have experienced a significant decline or financial distress but have the potential for a successful recovery.

- These companies are often undergoing management or operational changes to reverse their fortunes.

- Investing in turnarounds can be risky but can yield substantial returns if the turnaround is successful.

Asset Plays:

- Asset plays refer to companies that have undervalued or underutilized assets, such as real estate or intellectual property, which can be unlocked to create value.

- These companies may not have strong operational businesses but possess valuable assets that can be monetized or utilized in a strategic manner.

Peter Lynch’s investment philosophy revolves around understanding natural advantages, focusing on industries within one’s expertise, and simplifying the decision-making process. His approach encourages investors to prioritize knowledge and comprehension of individual companies rather than being swayed by external factors. Lynch’s approach highlights the correlation between a company’s earnings and its stock performance, undermining the significance of fundamental analysis over external factors.

Like this article? Don’t forget to share it with your friends! Follow me on Twitter and YouTube for more educational content.