Foreword:

Support and resistance levels are a critical part of trend analysis because they are used to make specific trading decisions. The fact that these levels flip roles between support and resistance can be used to determine the range of a market, trade reversals, bounces, or breakouts. These levels exist due to the influx of buyers and sellers at key junctures.

Support and resistance levels can be drawn using a variety of technical indicators such as Moving averages, horizontal levels, trendlines, etc. (which are freely available on TradingView). These levels are used to indicate price points where the odds favour a trend pause or reversal.

This post will shed some light on these questions:

1. What is a support level?

2. What is a resistance level?

3. What is their importance?

4. When & where to place Buy/Sell orders?

Please remember this is an educational post to help all of our members better understand various concepts used in trading or investing.

Support:

Support is a zone where the price tends to find a cushion as it falls or it is a price level at which a downward trend is anticipated to pause due to a concentration of demand. In general, the price is more likely to “rebound” from this level rather than pierce through it. However, once the price breaks down from this level, it is likely to continue falling until meeting another support.

Illustration:

Exhibit 1:

Exhibit 2:

Resistance:

It is a zone where the price tends to find resistance as it rises. In general, the price is more likely to “bounce back down” from this level. However, once the price pushes above this level it is likely to continue rising until it meets another resistance.

Illustration:

Exhibit 1:

Exhibit 2:

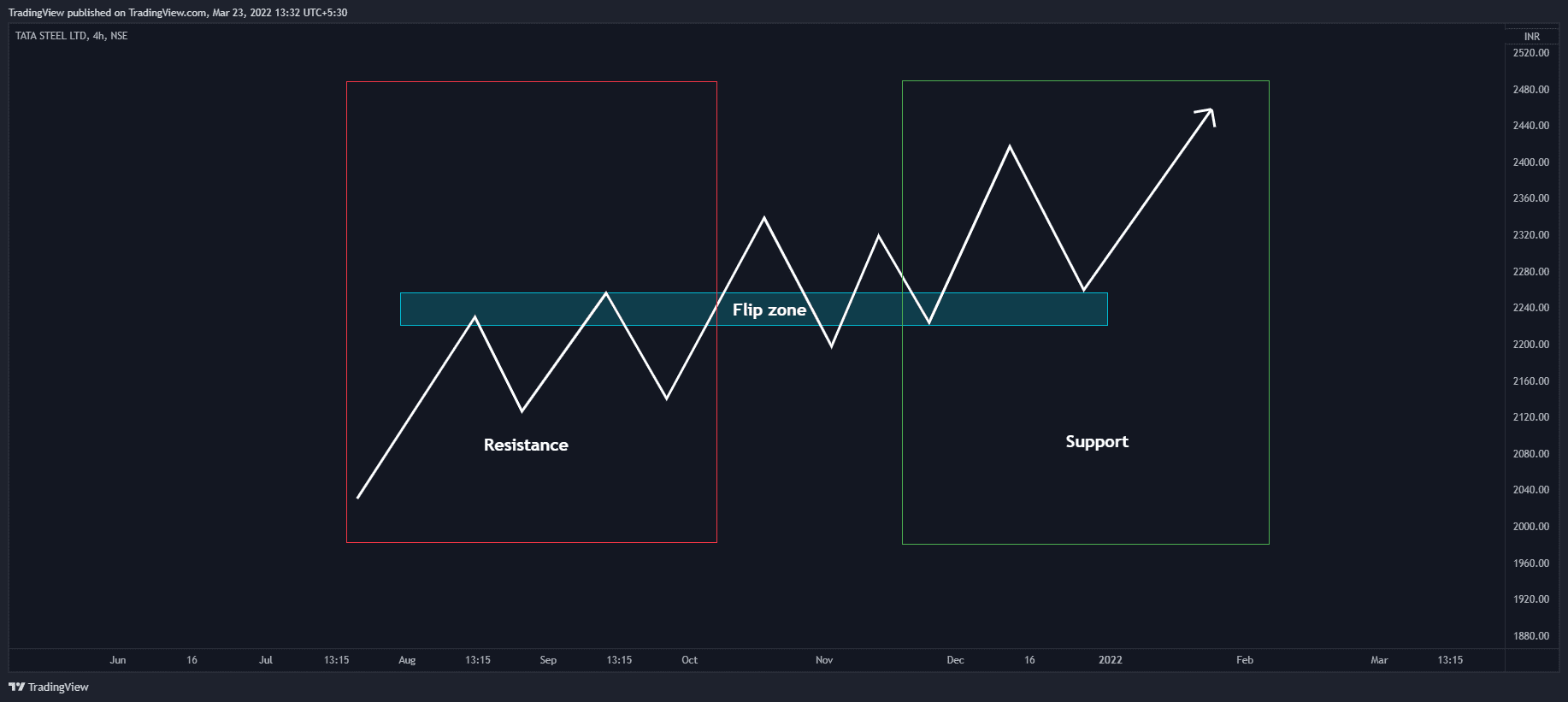

Role reversal/Change of polarity:

A resistance level after a successful breakout turns into support and a support level after a breakdown turns into resistance. This is known as “Change of Polarity” and the zone is called a “Flip zone”.

Illustration:

Exhibit:

Sample trade setups using support and resistance:

1. Buying the support

If after being rejected several times by the resistance, the price finally manages to break out. The right course of action can be to wait for a successful retest of this level, before going long. This is done in order to avoid fake breakouts/bull traps.

2. Selling the resistance

If after being rejected several times by the support, the price finally manages to break down. The right course of action can be to wait for a successful retest of this level, before going short. This is done in order to avoid bear traps.

Conclusion:

A zone keeps on flipping roles between support and resistance. It serves as a support at times and a resistance at others. As a result, these zones should be regarded as possible support or resistance zones, as there is no guarantee that they will operate as desired zones.

Pro Tip:

Since there is an influx of buyers and sellers at the support and resistance level , hence there is a lot of liquidity around these points. Therefore, it is not wise to place orders close to these levels. Always keep a buffer.