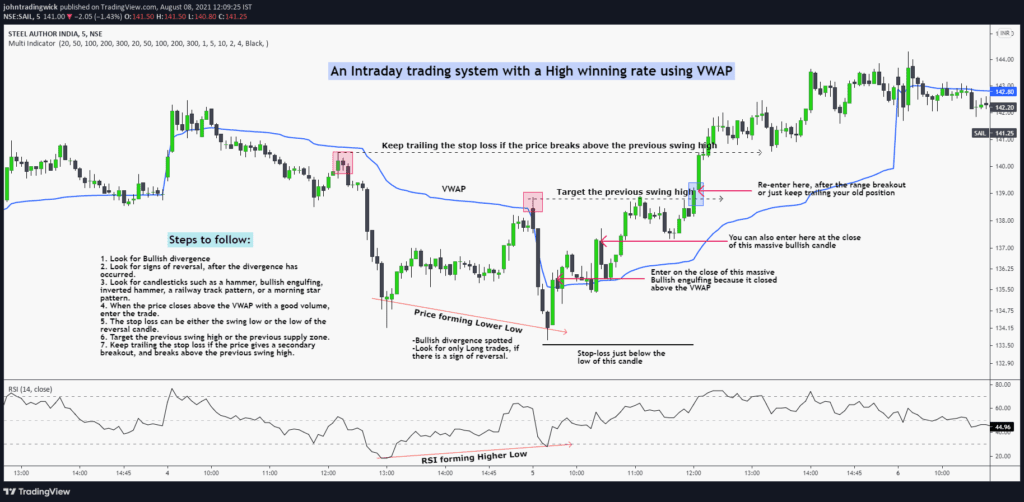

Dear reader, this is a full-fledged intraday vwap trading strategy. If you follow all the mentioned steps correctly, you will definitely have a great winning ratio. You can back-test this system on any instrument, stock, commodity, forex, etc. This system should only be used to take “Long” trades using the 5 min time frame on a stock that has sufficient liquidity.

A step-by-step guide to intraday VWAP trading strategy:

1. Look for Bullish divergence – The first and foremost thing that you need to do is to look for the bullish divergence. The bullish divergence must be either strong, medium, or hidden bullish divergence. Ignore the weak bullish divergence.

2. Look for early signs of reversal, after the divergence has occurred – As soon as you spot divergence, look for different signs of reversal. These can include either some reversal, neutral candlestick patterns or a sharp curve in RSI along with the formation of some bullish candlestick .

3. Look for candlestick patterns – You should look for the candlesticks such as a hammer, bullish engulfing, inverted hammer , a railway track pattern, morning star pattern.

4. When to enter the trade? –You should wait for the price to close above the VWAP and there must be some sort of increase in volume which confirms the buying interest. When the price closes above the VWAP with a good volume, enter the trade. Until both of these conditions are met, do not enter the trade.

5. How to set stop loss? – The stop loss can be either the swing low or the low of the reversal candle. Also, you can either use a fixed stop loss or trail your stop loss to the succeeding swing lows.

6. How to choose the target? – The minimum target should be the previous swing high or the previous supply zone. You can keep trailing your position if the stock keeps giving multiple breakouts.

Thanks for reading. Hope this was helpful.