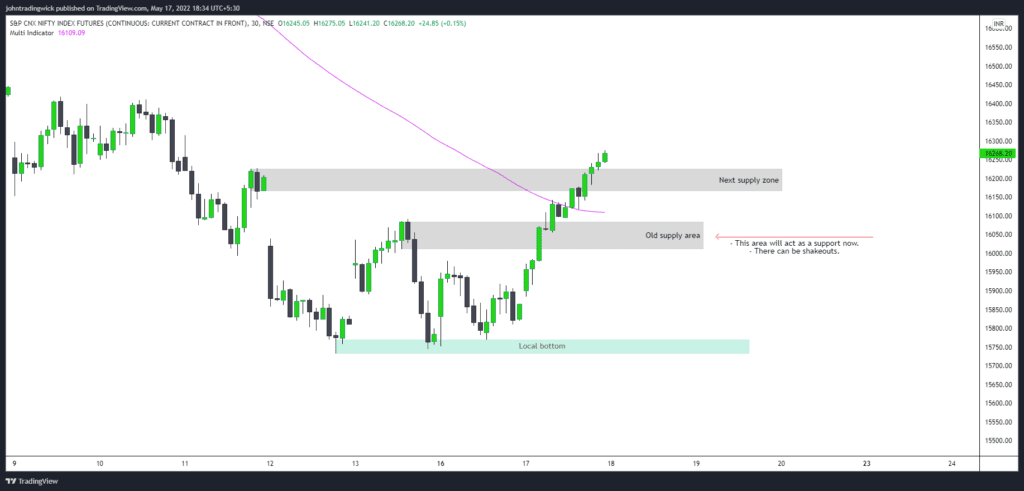

Nifty analysis – 17 May: Current outlook

- Seems like the local bottom is in. We are in for a relief rally.

- The previous supply zone at 16k-16.1k seems to be getting violated. If the price sustains above 16100, expect further up move in the coming days.

- The next supply zone lies somewhere near 16150-16200.

- The LTF bias is bullish, all the dips seem like a buying opportunity today.

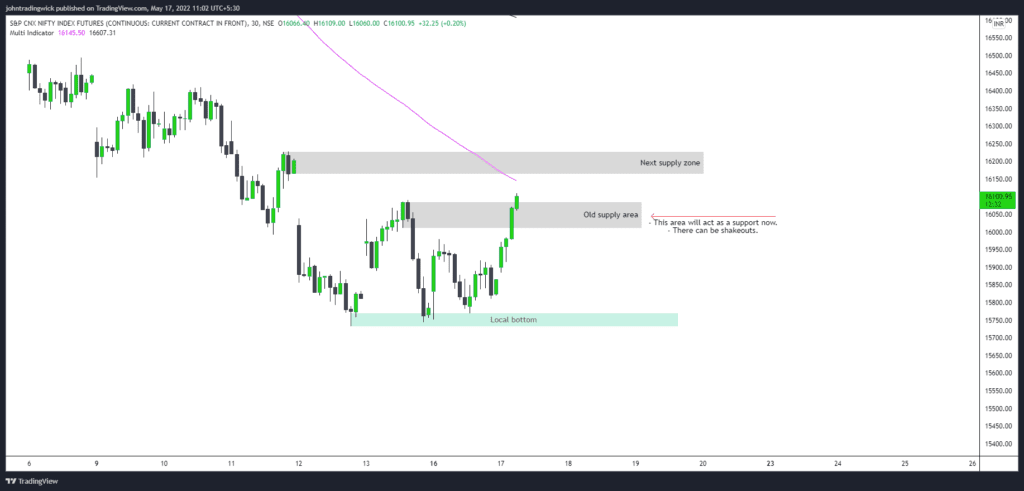

Nifty analysis – 17 May | Update (12:02 pm)

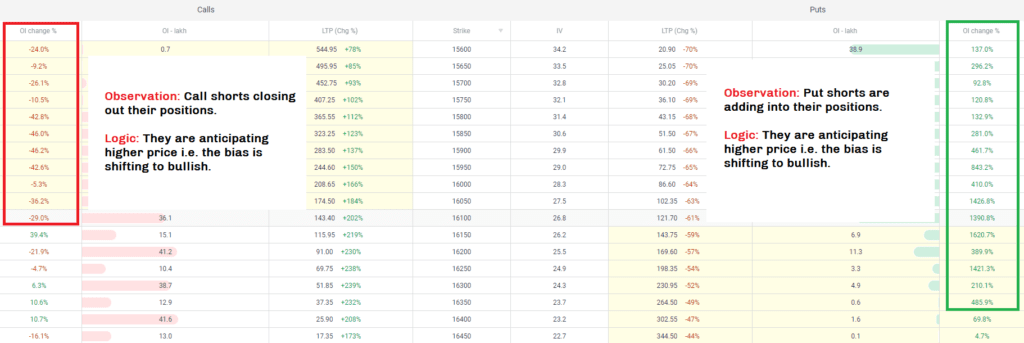

Nifty OI data interpretation:

Observation: Call shorts closing out their positions. These are trapped shorts that are fueling the up move by their aggressive short covering.

Logic: They are anticipating a higher price i.e. the bias is shifting to bullish.

Observation: Put shorts are adding into their positions.

Logic: They are anticipating a higher price i.e. the bias is shifting to bullish.

This only solidifies my bias that a local bottom has been formed in Nifty and we are heading for a relief rally. I don’t use OI data on a standalone basis because it’s useless.

Nifty analysis – 17 May | Update (12:32 pm)

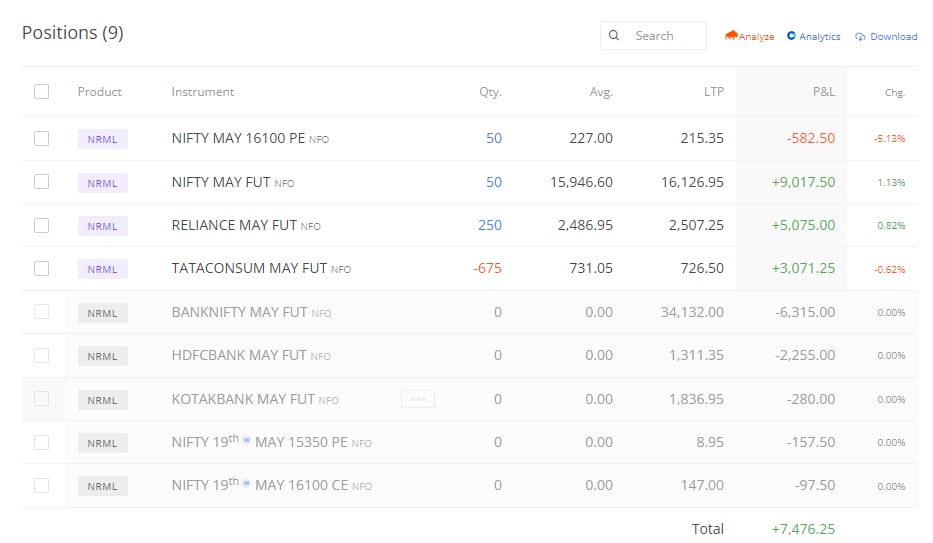

Currently holding these positions. Like I always say, the PnL doesn’t matter. This is just to show that I have skin in the game, I don’t only post charts.

- BNF-NF pair trade converted into NF long. Now, it’s hedged long because I may carry it overnight. Not really sure at the moment.

- Kotak Bank- HDFC Bank pair trade converted into Reliance-Tata Consumer pair trade.

- All the positions are in futures. Therefore, the MTM is giving me anxiety because I am not used to such big positions.

Let’s see how these pan out, I may close out these positions altogether. It all depends on my mood.

Nifty analysis – 17 May | Update (01:00 pm)

Closed out all the positions. I was getting impatient and fearful. A trader needs a clear mind and a great deal of control over emotions to carry overnight trades. Unfortunately, I am lacking these at the moment. No shame in accepting that.

Outcome: +8k for that day. ROI = 1.5%

Update EOD:

The price has invalidated all the supply zones. Today was a pure trending day, controlled by OTF traders.