A ‘logical stop loss’ in options refers to a prudent and objective stop-loss level that is based on the price action or some reliable indicator, rather than on the trader’s whims.

In general, a logical stop loss varies from one situation to another.

Some Logical Stop-loss in Options:

1. Swing high/low

2. Low of the Hammer / Inverted hammer

3. High of the Shooting star / Hanging man

4. Low of the demand zone

5. High of the supply zone

Broadly there are 2 ways to set a stop loss in options.

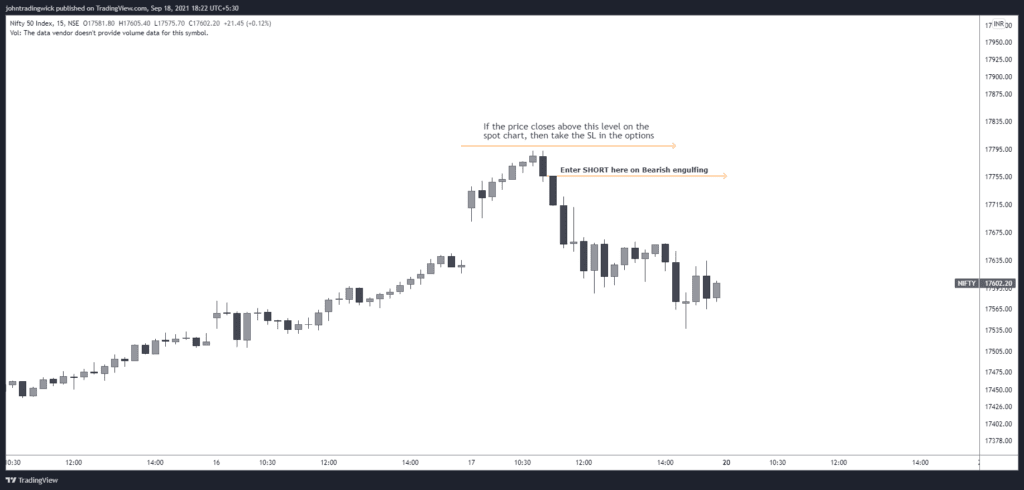

1. Place the SL using the spot chart

Placing a stop loss using the spot chart can save you the trouble of constantly monitoring the options chart. However, it’s important to note that calculating the exact loss beforehand can be challenging as the movement of spot and options prices is not always linear and is influenced by various Option Greeks. Despite this limitation, using the spot chart is a simpler approach since you only need to refer to a single chart.

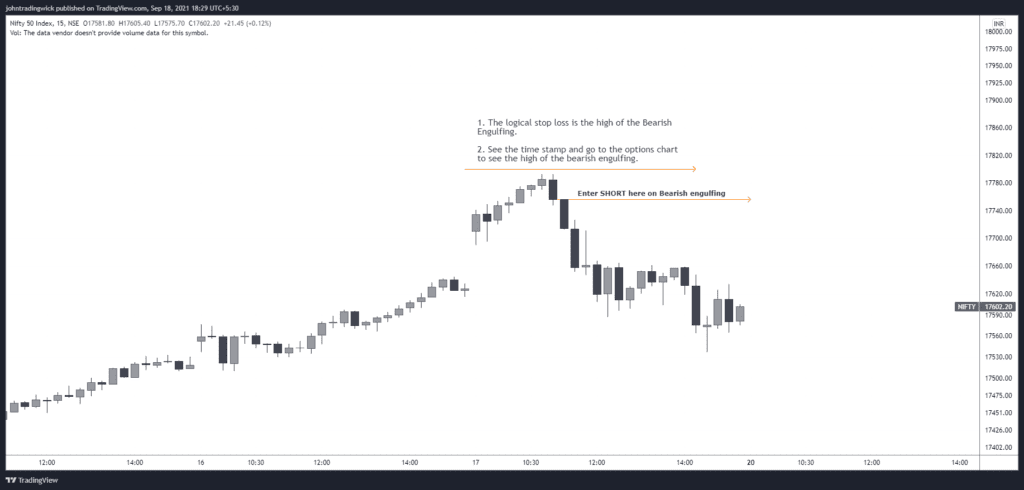

2. Place the SL using the Options chart

2. If you place the stop loss using the Options chart, you will be able to calculate the exact loss beforehand. To check the options chart, you must use your broker’s terminal or some paid third-party site. TradingView doesn’t provide option charts. This method is a bit difficult compared to the first method.

To place a logical stop-loss in using this method, follow these steps:

- Check the spot chart.

- Execute your buy/sell order.

- Notice the logical stop loss in the spot chart

- Check the same SL in the options chart

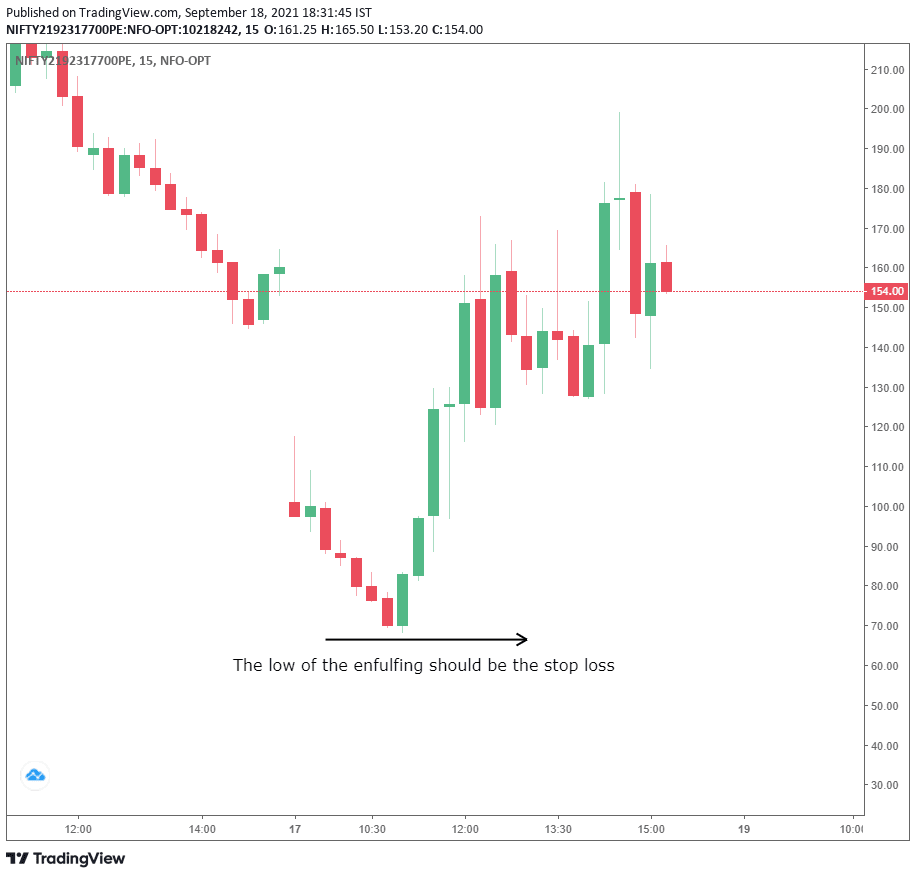

- Now open the options chart of the option you bought/sold.

- See the relative position of the stop loss in the options chart. (Whatever SL that you selected in the spot chart in step 3, select that same SL but now in the options chart.)

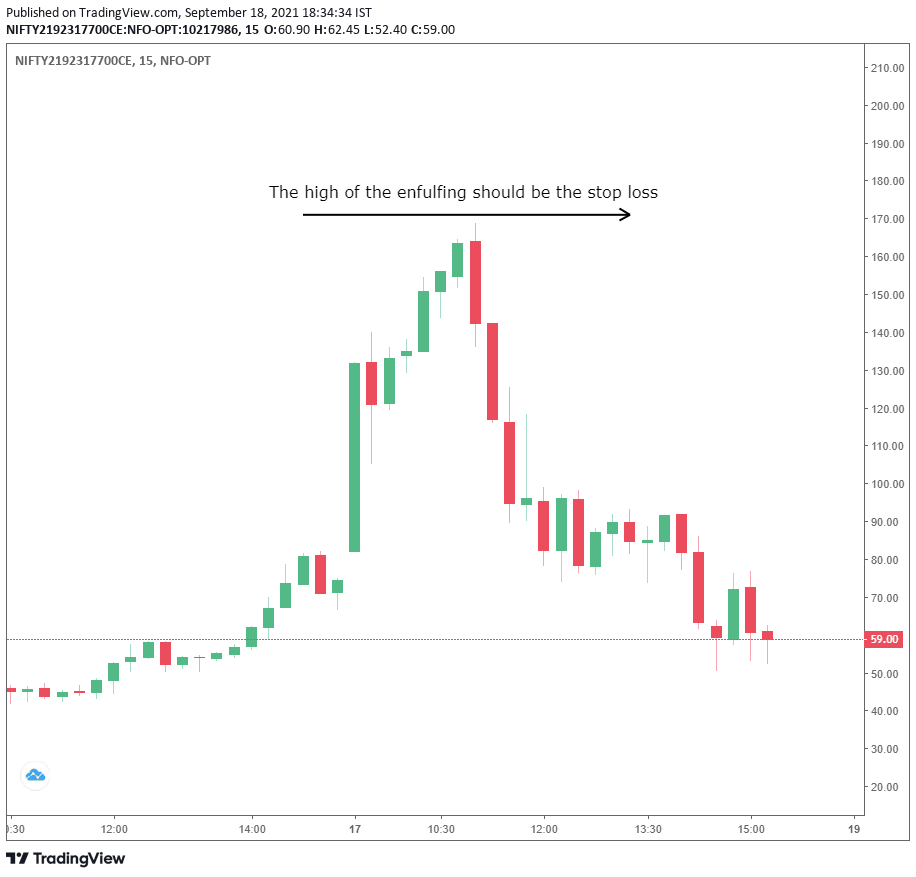

- In the above case, suppose you Shorted Nifty. So, you can either buy a PUT option or sell a CALL option. The stop loss in both cases is as follows:

If you buy a PUT option:

If you sell a CALL option:

6. Now that you have chosen your stop-loss, just place your stop-loss order. That’s it, you are done. This is how we place a logical stop loss in options.

Like this article? Don’t forget to share it with your friends! Follow me on Twitter and YouTube for more educational content.