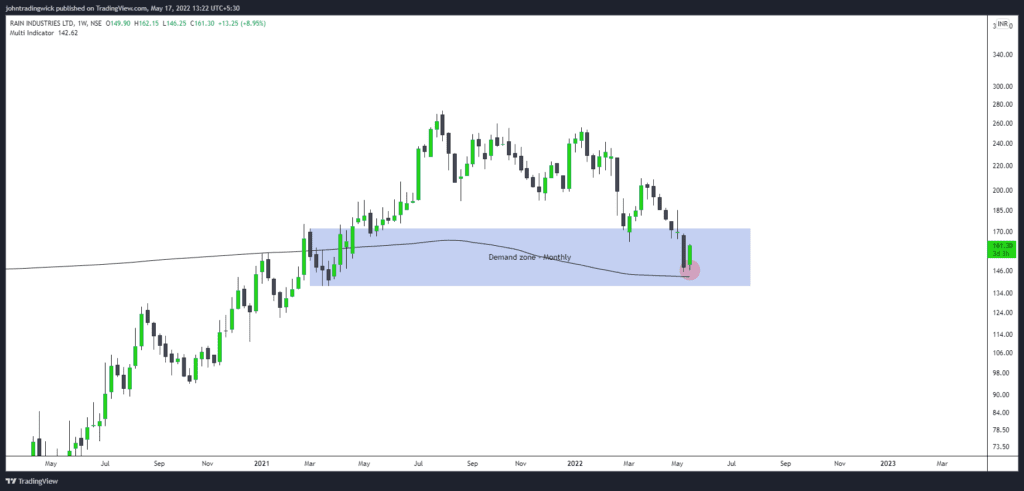

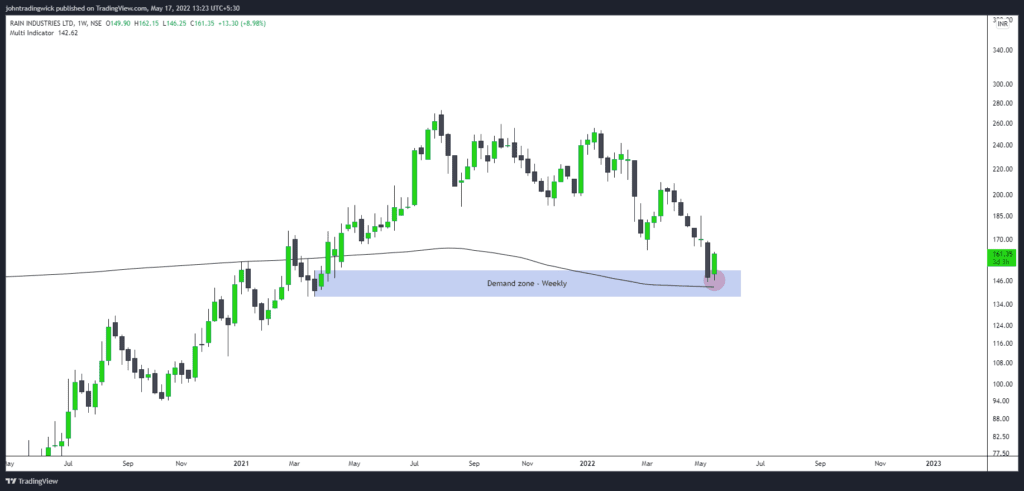

- Currently sitting in the weekly demand zone and above 200MA.

- Seems to be bouncing off this confluence zone.

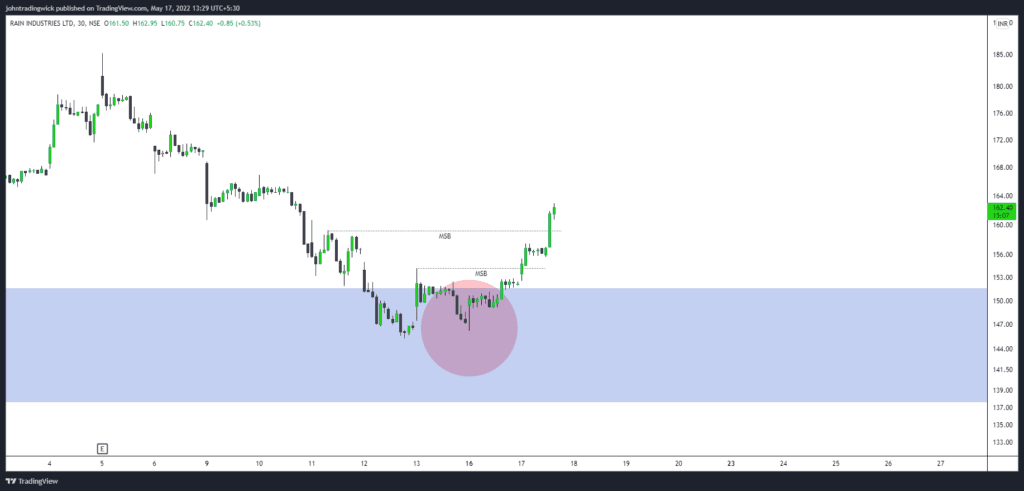

- Multiple breaks of structure on lower time frames.

- Volumes should pick up soon.

- If you feel like taking a long, use 145 as stop loss (Daily closing basis).