The Cup and Handle pattern was first introduced by William O’Neil in his book “How to Make Money in Stocks”. Since then, this pattern has gained widespread recognition among traders and investors alike.

The purpose of this article is to offer insights into the following topics:

➡ Fundamentals and identification of the Cup and Handle pattern

➡ Key components

➡ Essential aspects

What is a Cup and Handle pattern?

- The Cup and Handle pattern is a widely recognized bullish continuation pattern. This pattern is formed when the price of an asset experiences a period of consolidation, followed by a slight dip in price (the handle), before resuming its upward trend.

- While the Cup and Handle pattern is often seen in uptrending assets, it can also occur in assets that are in a downtrend or have been trading sideways. In these cases, the pattern can signal a potential trend reversal or the beginning of a new uptrend.

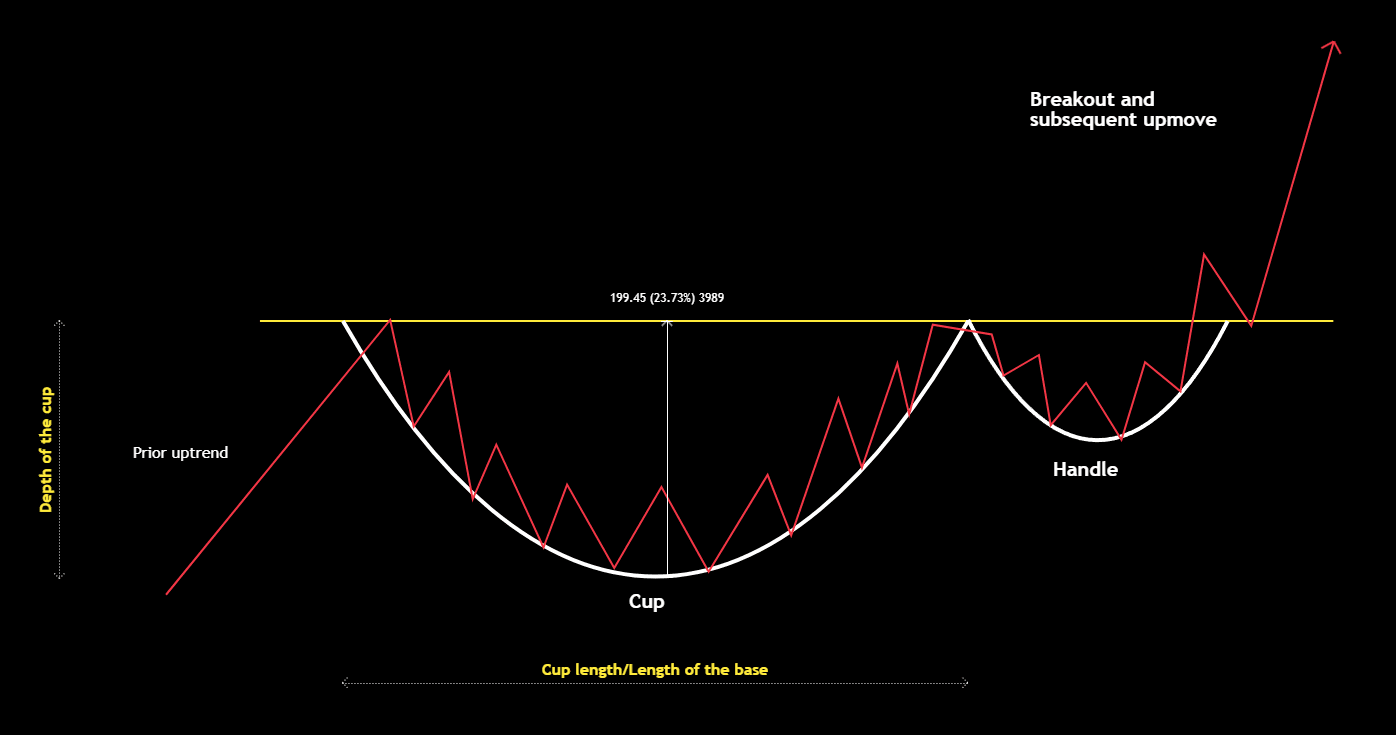

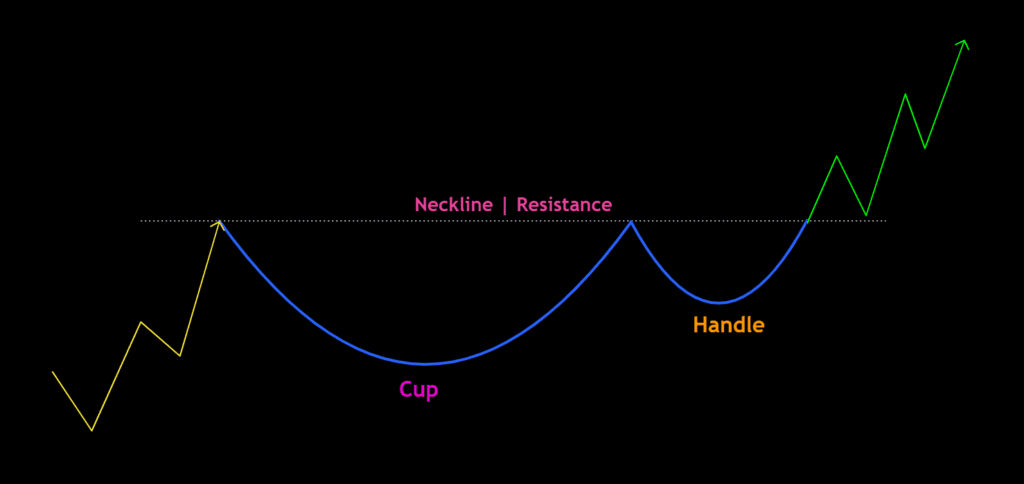

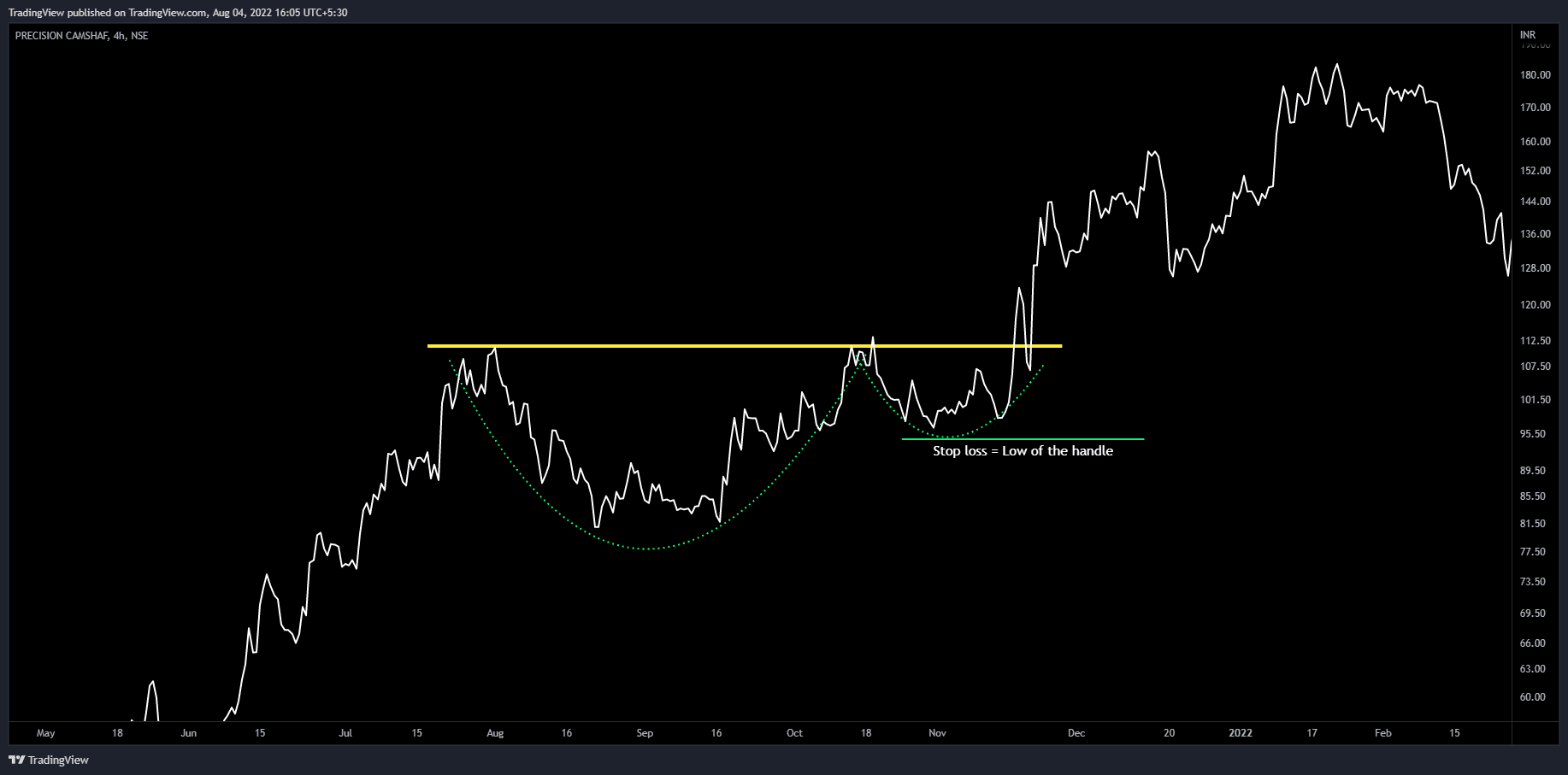

- The cup portion of the pattern is typically visualized as a “u” shape, resembling a rounding bottom pattern. This phase represents a consolidation period where the price of the asset moves sideways, forming a base of support.

- The handle is formed when the price of the asset pulls back slightly, creating a smaller “u” shape. This phase represents a retest of the support level established during the cup formation.

- The handle is a critical component of the pattern, as it is often seen as a buying opportunity for traders. If the handle forms correctly, it can signal that the consolidation period is coming to an end and that the price is likely to continue its upward trend.

- Once the handle formation is complete, the stock may reverse course and resume its prior uptrend. Traders can use this pattern as a signal to enter a long position in the asset, with a stop-loss order placed just below the support level established during the cup formation.

Key Components of a Cup and Handle Pattern:

The pattern consists of three key components:

- Cup

- Handle

- Neckline/Resistance

Important aspects:

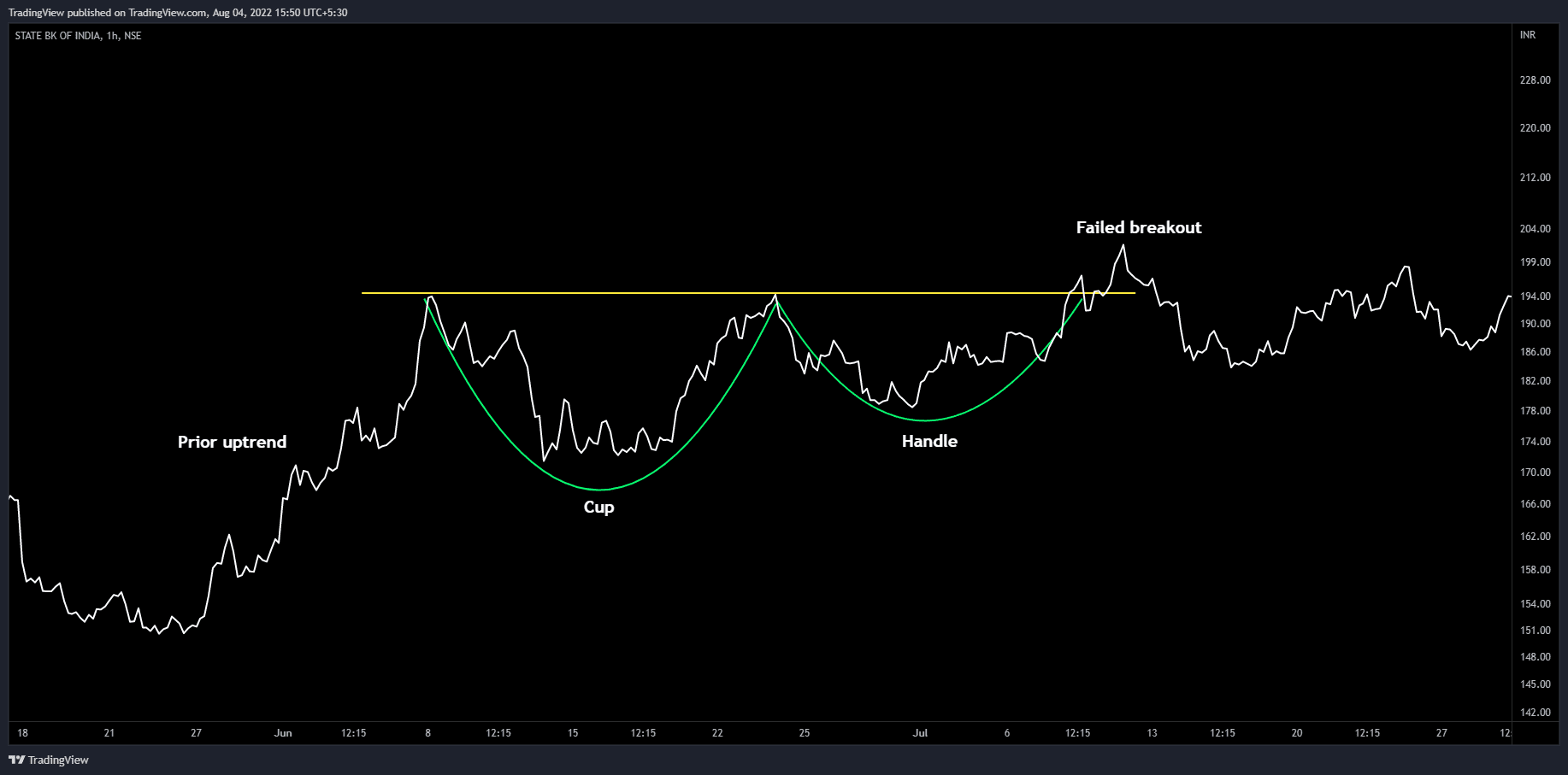

1. Prior Trend

In general, the Cup and Handle pattern is a bullish continuation pattern and occurs in up-trending stocks. However, some traders also use it as a reversal pattern in a downtrend or sideways trend.

2. Cup length

When analyzing the Cup and Handle pattern, it is important to pay attention to the shape and characteristics of the cup formation. Typically, cups with longer and more “U” shaped bottoms provide a stronger signal, indicating a more prolonged period of consolidation and a stronger base of support.

Ideally, the perfect Cup and Handle pattern would have equal highs on both sides of the cup, indicating a symmetrical and stable consolidation phase. However, this is not always the case, and traders should be cautious when analyzing asymmetrical cups. While an asymmetrical cup can still be a valid pattern, it may indicate a less stable consolidation phase and a weaker support base.

On the other hand, cups with sharp “V” shaped bottoms should generally be avoided, as they indicate a lack of consolidation and weak support levels. These types of cups are less likely to provide a valid base for the subsequent handle formation and can lead to false signals.

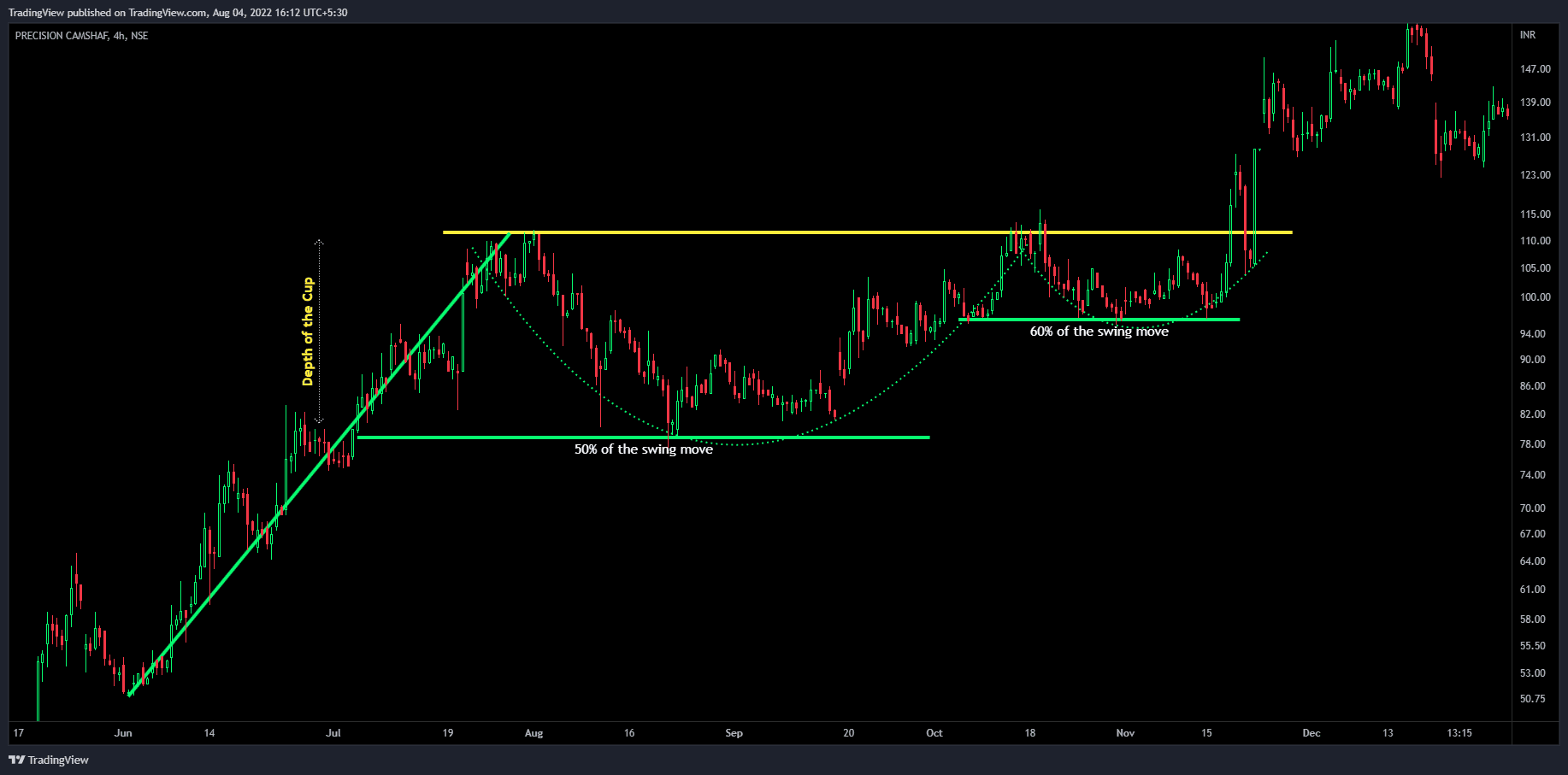

3. Cup depth

While the ideal depth of the cup formation can vary widely depending on the asset being analyzed, a depth of up to 60-70% of the previous uptrend may still be considered valid. However, in general, it is best to look for cup formations with a depth of around 50% of the previous uptrend.

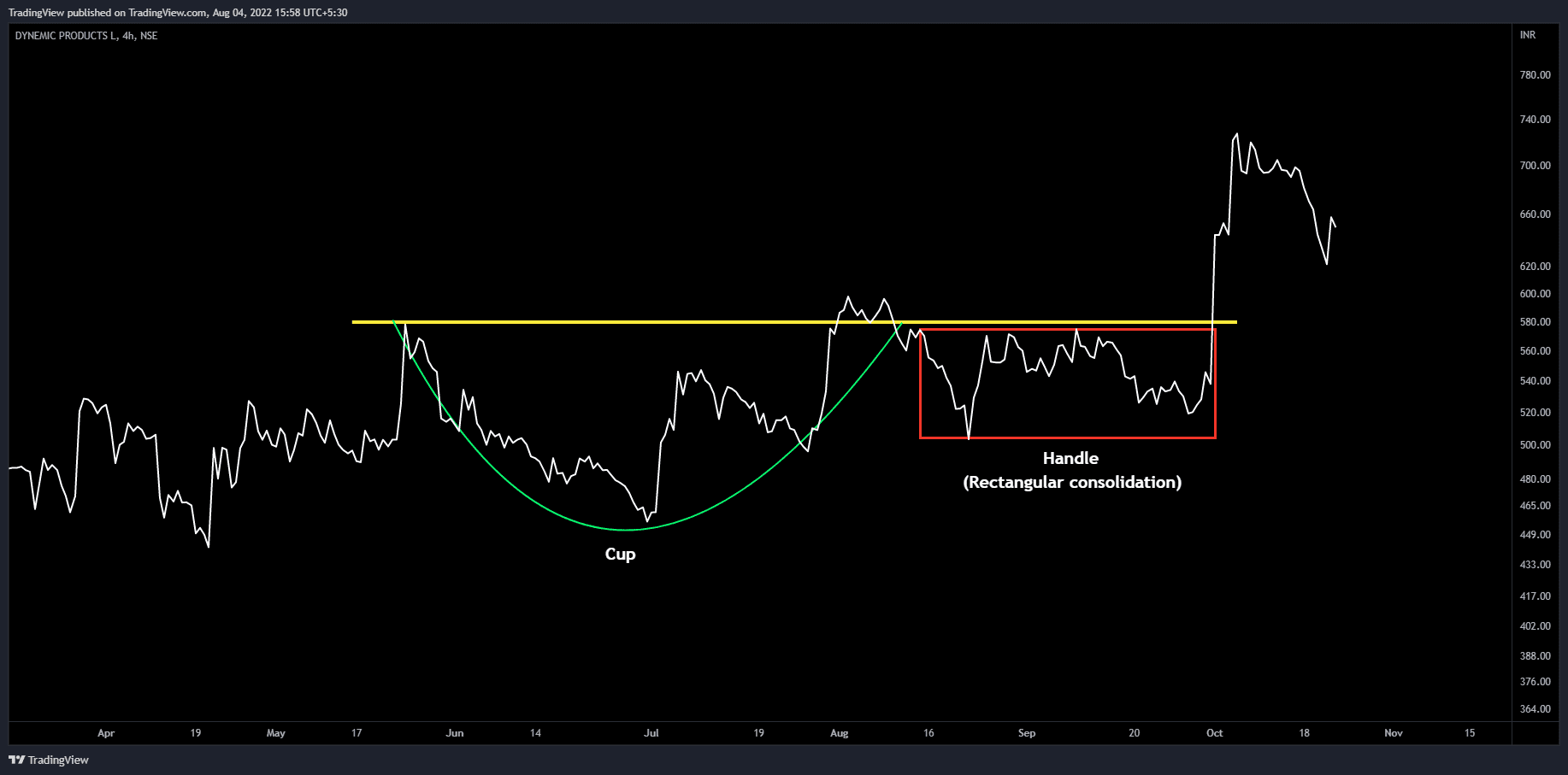

4. Handle

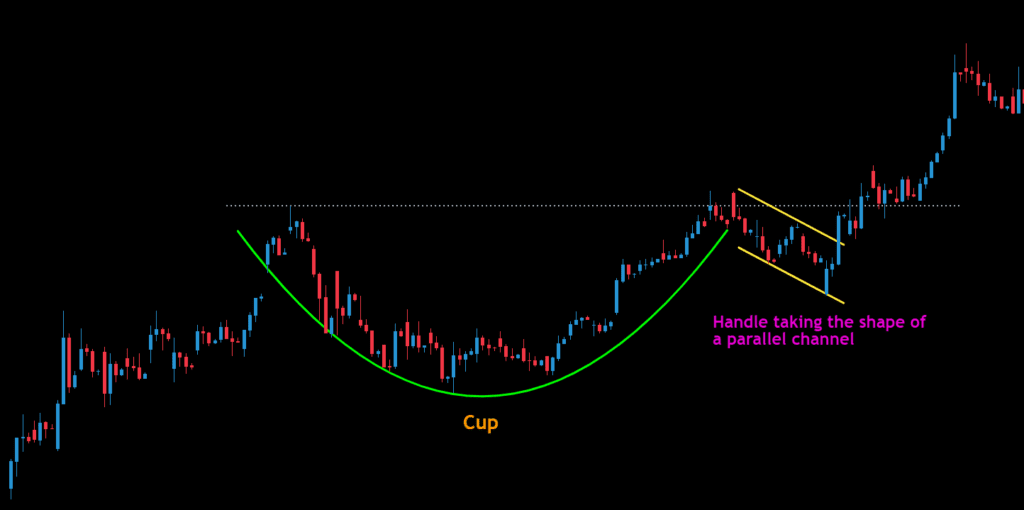

The handle can occur in several forms, including a flag, pennant, or rectangular consolidation, and typically retraces anywhere between 40-60% of the depth of the cup.

However, it is important to avoid handles that are overly deep, as they may weaken the bullish signal and decrease the likelihood of a continuation of the uptrend. Generally, the best Cup and Handle patterns have a shallow retracement on the handle, with a depth not exceeding 50% of the cup. In some cases, the price may also retrace up to the 0.618 Fibonacci level.

5. Breakout

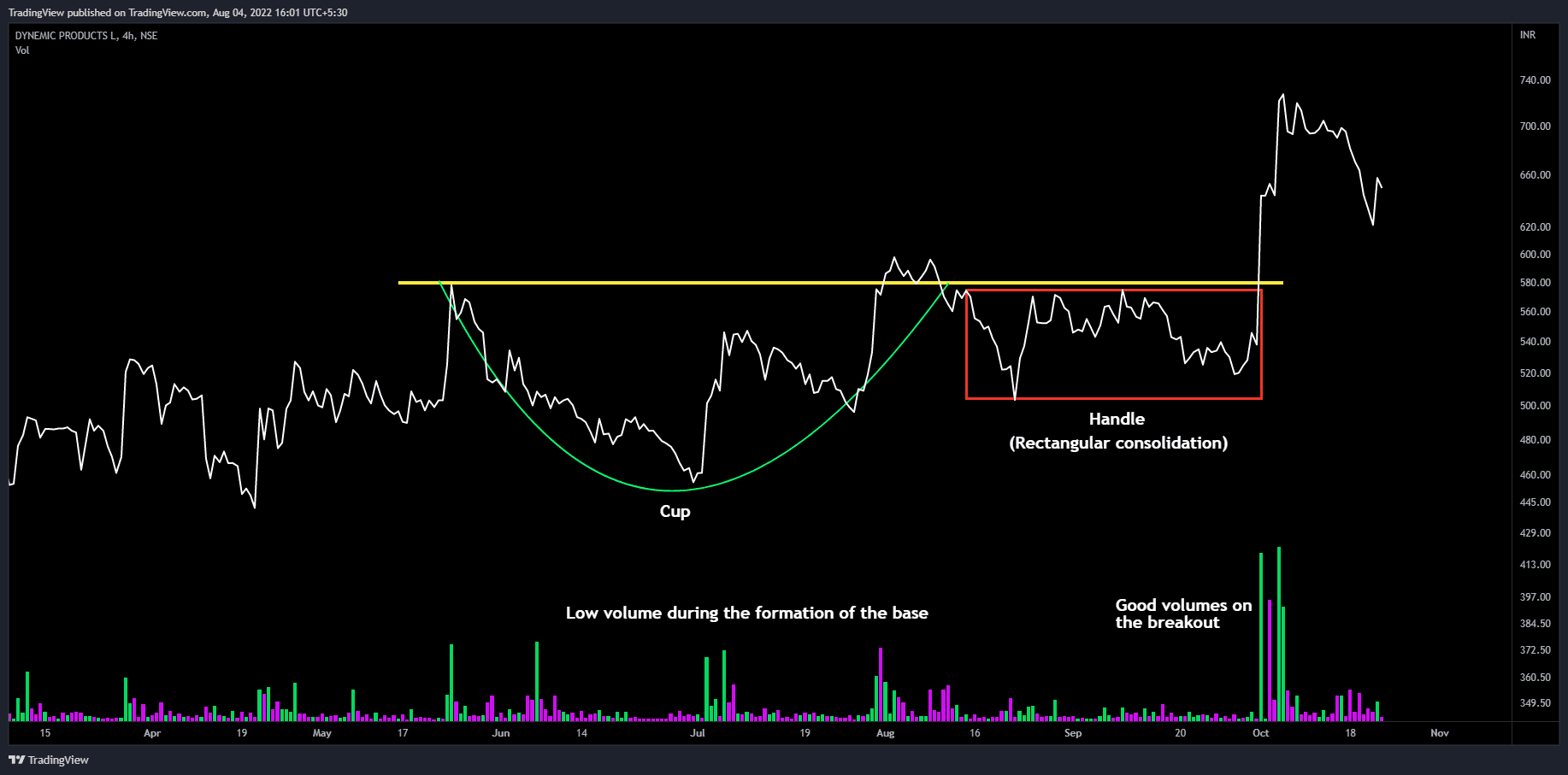

A breakout above the reaction highs and neckline serves as a bullish confirmation of the Cup and Handle pattern. When the price breaks above the neckline or the resistance level, accompanied by a surge in trading volume, the pattern is considered complete, and a bullish trend is expected to follow. It’s important to note that after the breakout, the price may test the demand by returning to the neckline before moving higher.

6. Volume

Ideally, the trading volume should decrease during the formation of the base of the cup as well as during the formation of the handle. Conversely, the volume spike when the price breaks above the neckline level, confirming the breakout. However, it’s essential to note that these are only guidelines and the actual volumes may vary in practice.

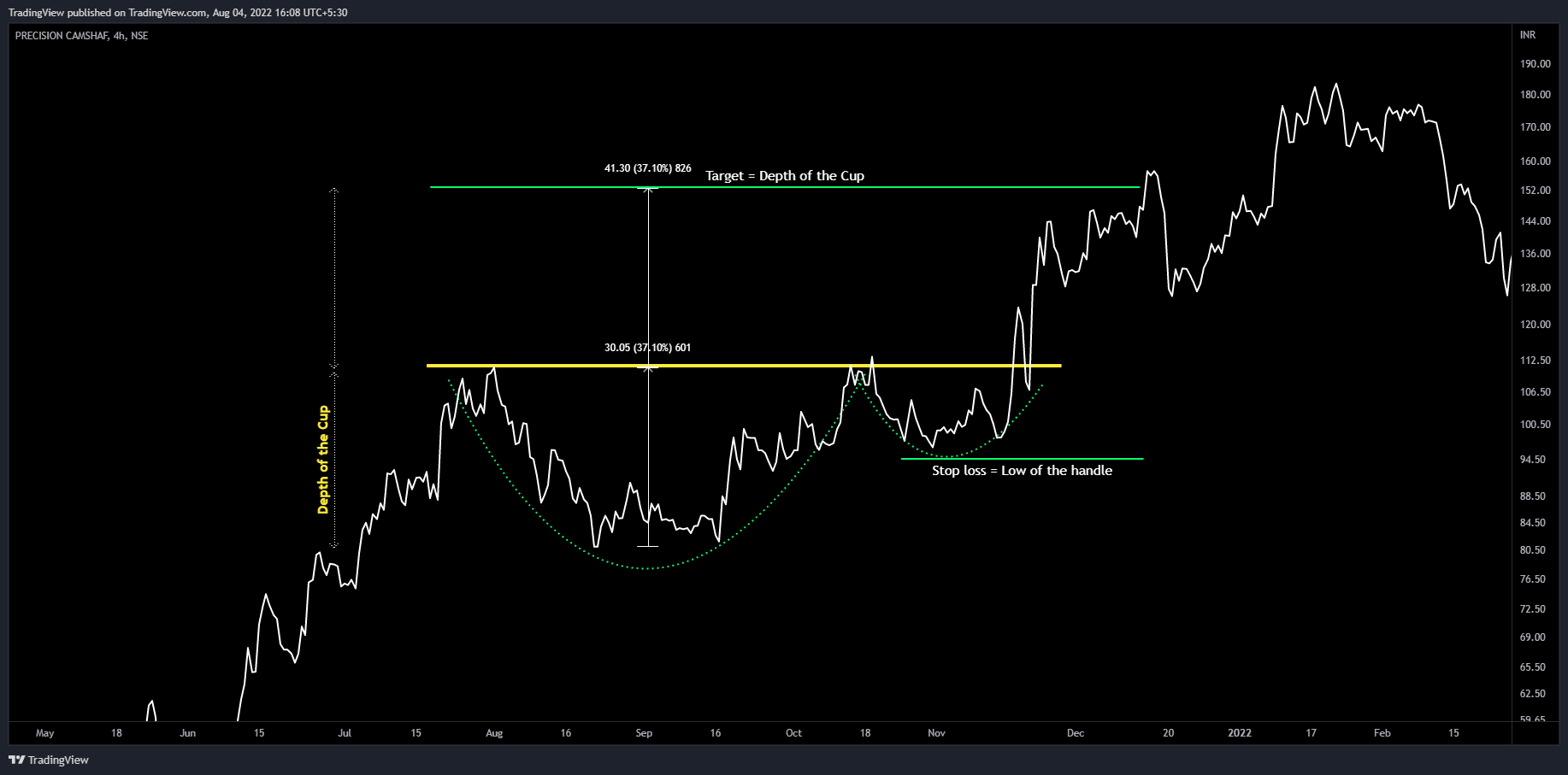

7. Target

Using the measurement objective technique, we can easily determine the target of the Cup and Handle pattern, which is equal to the depth of the cup. To calculate this, measure the vertical distance between the lowest point of the cup’s base and the neckline. By adding this distance to the breakout point, we can estimate the price target for the up move.

8. Stop-loss

One common approach is to place the stop-loss at the lowest point of the handle. This level is often seen as a critical support level, and a break below it can indicate that the pattern has failed and that the asset is likely to continue its downward trend.

However, in situations where the price oscillates up and down several times within the handle, placing the stop-loss at the lowest point may not be the most effective approach. In these cases, then the stop-loss order can also be placed below the most recent swing low.

Exhibits

A Cup and Handle pattern with a shallow handle in the shape of a parallel channel

A Successful Cup and Handle pattern with a V-shaped cup and a shallow handle

Cup and Handle pattern with a failed breakout

Like this article? Don’t forget to share it with your friends! Follow me on Twitter and YouTube for more educational content.