Read the latest and updated post on “How breakout traders get trapped“.

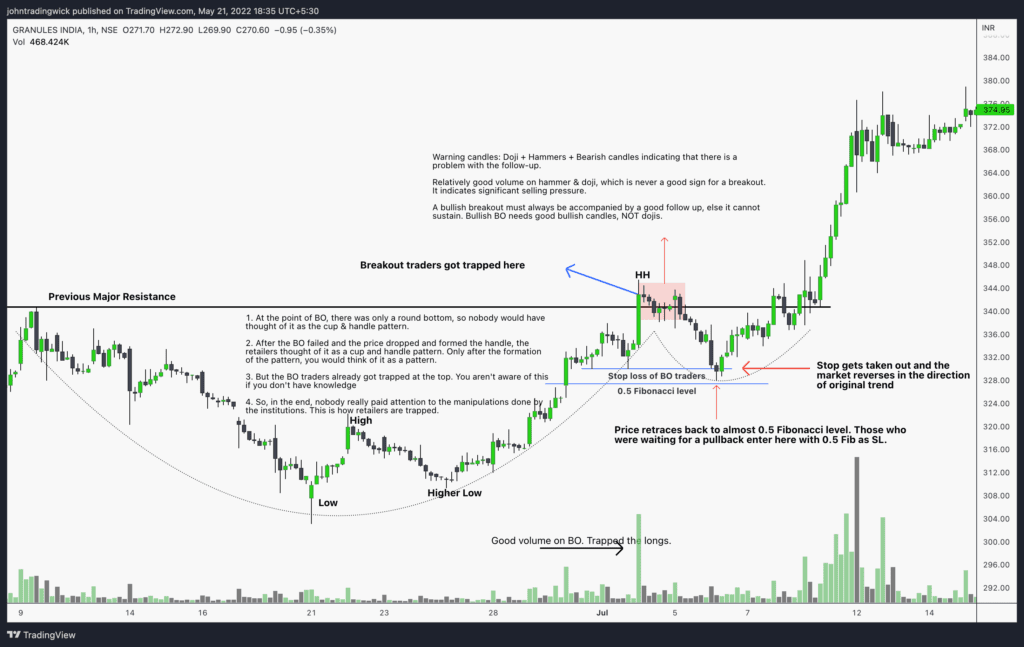

To understand how breakout traders get trapped, you need to understand the example above. Notice the following:

– Warning candles: Doji + Hammers + bearish candles indicating exhaustion and a lack of follow-up.

– A relatively higher volume on hammer & doji, which is never a good sign for a breakout because it indicates significant selling pressure.

– A bullish breakout must always be accompanied by a good follow-up, else it won’t sustain. Bullish BO needs good bullish candles, NOT dojis.

Underlying concepts:

1. For a bullish market, the price must form a series of higher highs and higher lows. Similarly, for a bearish market, the price must form a series of lower highs and lower lows.

2. Whenever the price reaches a resistance level, there are 2 types of traders that take positions:

– Those who short the level in anticipation of it acting as a resistance.

– Those who long early in anticipation of resistance being taken out.

3. The stop losses of these traders act as liquidity. A short position has a “buy order” as SL, whereas a long position has a “sell order” as SL. Hence, these trapped breakout traders act as liquidity for the counter-party.

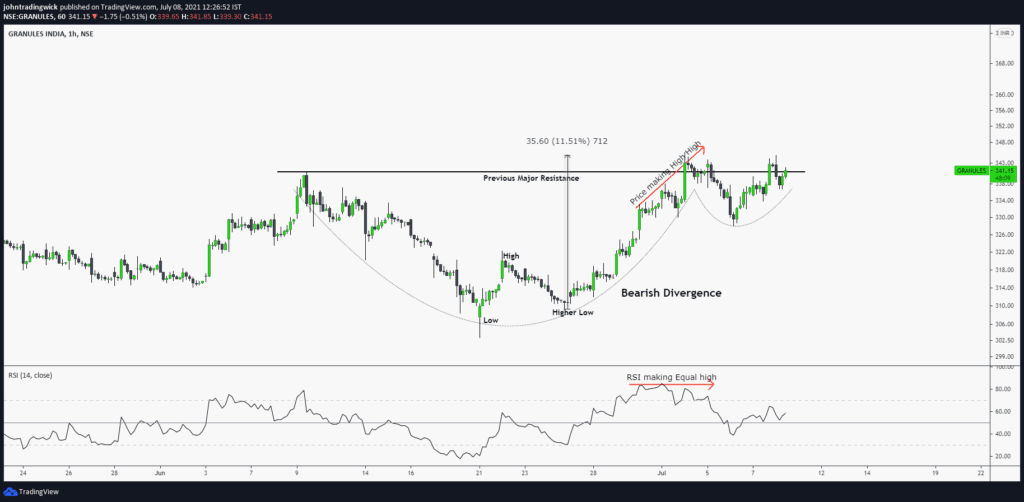

4. In the example above, the market already gave 11% in the impulsive move and created a high. The momentum was fading out. There was Bearish divergence. The price was moving up and up but the RSI was creating an equal high indicating that there isn’t enough buying pressure (I have already covered this in my older posts).

Psychology and Behind the scenes stuff (In the example above):

1. At the point of breakout, there was only a round bottom, so nobody would have thought of it as the cup & handle pattern.

2. After the failed breakout and the price dropped and formed the handle, the retailers thought of it as a cup and handle pattern. Only after the formation of the pattern, you would think of it as a pattern.

3. But the breakout traders already got trapped at the top. If you aren’t aware of the concept, you will definitely be unable to make it out.

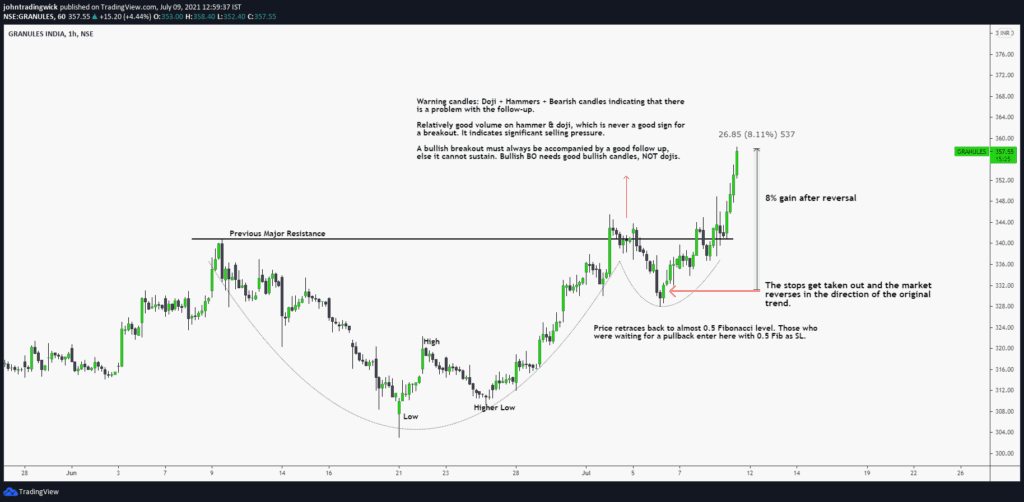

Update:

- When the stops got taken out, the market continued its original direction and now gave 8% gain.

- Those who entered at the 1st breakout got fooled and lost money. But those who entered at the pullback gained almost 8% in 2 days.

So, this is how breakout traders get trapped.

Thanks for reading! Hope this was helpful.